The Big Four Economic Indicators: Real Retail Sales

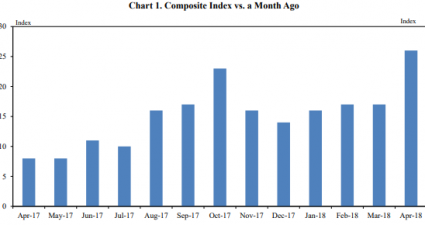

Note from dshort: With yesterday’s release of the Consumer Price Index for October, I’ve updated Real Retail Sales for October. Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. This committee statement is about as close as they get to…