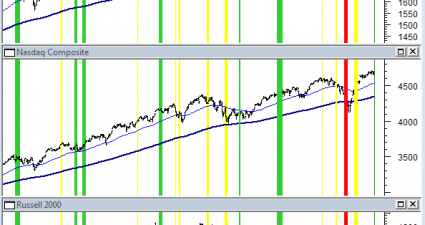

Risk Falling

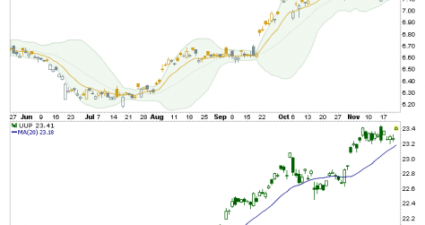

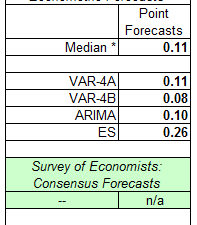

Over the past week most of our core market health indicators improved a bit. Our core measures of risk made it into positive territory. As a result, long/cash allocations will now be 20% long and 80% cash. The hedged portfolio will be 60% long stocks we believe will out perform in an uptrend and 40% short the…