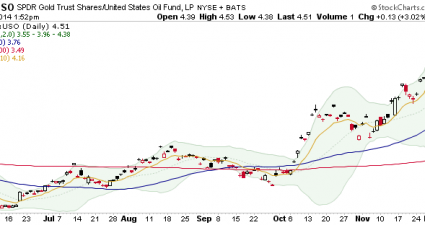

Importance Of Using Trailing Stops When Trend Following $BABA $QL

In order to succeed when trading and trend following one truly needs to believe that anything can happen. Do not fall in love with your favorite stocks. Do not let them make a round trip. Use trailing stops and lock in profits while you can. Watch this example with BABA.