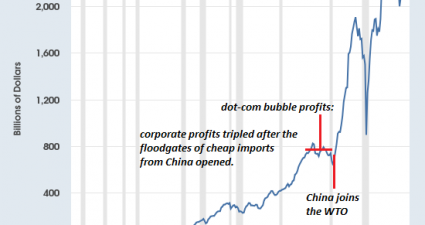

FANG Stocks Rebound As Trump And Kudlow Ease Trade Tensions

Stocks opened higher on Monday after officials in President Donald Trump’s administration downplayed the potential impact of any looming trade war between the U.S. and China. The morning’s biggest winners were tech stocks, with the so-called “FANG” group—Facebook FB, Amazon AMZN, Netflix NFLX, and Alphabet GOOGL—witnessing a slight rebound from Friday’s selloff. Key officials in the White House appear…