Monthly Archives: April 2018

Weekly Forex Forecast – Sunday, April 22

The EUR/USD pair initially tried to rally during the week but found the area above the 1.2350 level to be a bit too expensive. Now that we have pulled back from that area, we ended up forming a shooting star for the week. However, I see a significant amount of support below the 1.21 handle,…

The European Stock Market In 2018: A Defining Moment With An Amaz

The Stoxx Europe 600 index and its 600 components, represents the performance of a mix of large, Medium and Small companies in 17 European countries and approximately 90% of the market capitalization of the European Market. When analyzing the European Stoxx Europe 600 Index, we noticed how a quadruple top is forming on the long term price…

‘He’ll End Up Shooting Us In The Foot’: Trump’s $100 Billion Tari...

Earlier on Sunday, we noted that according to plans that aren’t yet plans, Steve Mnuchin might consider taking some time away from signing dollar bills to take a trip to China, where he would ostensibly try to convince Beijing that negotiating with Trump and Peter Navarro isn’t a lost cause. Of course it is a lost cause…

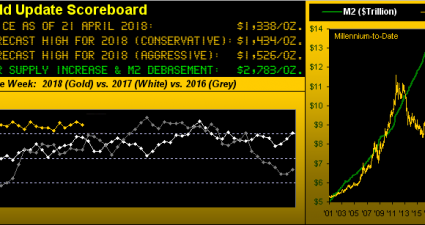

Silver Enthuses While Gold Snoozes

Now before we get into it, did you happen to notice that S&P/Experian’s consumer credit compilation just recorded its highest pace of credit card defaults since July 2012, indeed up for the fourth straight month? And note how it is coincident with the Fed having raised rates? You heard it first foretold here so many months…

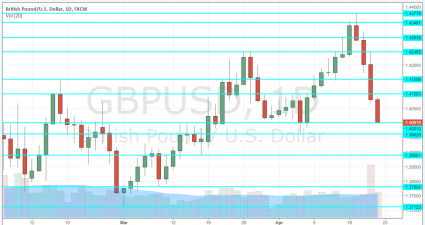

GBP/USD Forecast Apr. 23-27 – 5 Reasons For Pound Plunge, GDP Unl...

GBP/USD had a bad week when everything went wrong for the pound. After hardly holding onto 1.40, sterling now faces the GDP report and another public appearance by Mark Carney. Will it continue lower? Here are the key events and an updated technical analysis for GBP/USD. The bad news began with wages that remained stagnant at…

Weekly Market Outlook – The Least Opportune Time To Give Up

For the better part of the first half of April, it looked like the market was going to make good on the recovery hints it dropped early in the month. Now that entire effort is being called into question. Though the rebound gain was never a move backed by high volume, a major hurdle…

Yen Weakness Remains As Japanese Inflation Settles: The BoJ Is On

Talking Points: US Dollar Shows Strength Ahead of ECB, BoJ Rate Decisions. JPY in the Spotlight: Yen Weakness Shows Ahead of Japanese Inflation. Fundamental Forecast for JPY: Bearish This week saw a JPY in the Spotlight: Yen Weakness Shows Ahead of Japanese Inflation as the currency continues to step back from the ledge of risk aversion. The…

Dwindling Pipeline Capacity Causes FOMO

FOMO (Fear of Missing Out) hasn’t been much of a problem for energy infrastructure investors over the past year or so. Feelings of WAIL (Why Am I Long?) and (ahem) WTH have been far more common. So the recent rally in the sector has led many investors to enquire why. Earnings only began to be…

The Hurry Up And Wait Market

This market is beginning to remind me of boot camp; a “hurry up and wait” market. Waiting for what they’d never tell you, but I will. The bulls are waiting for the Dow Jones to break above last February 26th‘s -3.41% in the BEV chart below, while the bears are waiting for it to break…