This headline “US Recession Imminent – Durable Goods Drop For 5th Month, Core CapEx Collapses”, following on “Forget Recession: According To Caterpillar There Is A Full-Blown Global Depression”, impelled me to check to see if I'd missed something.

Term Spreads

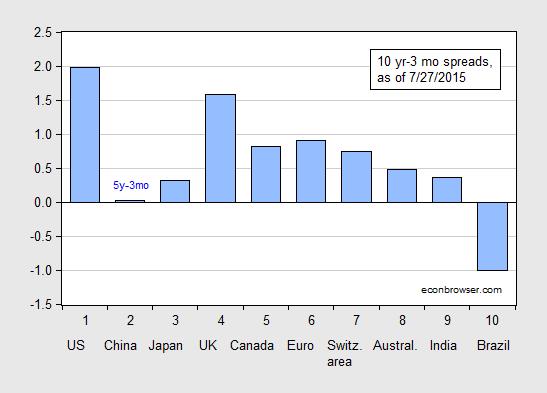

The first thing that I wanted to inspect was the term spread, in this case the 10 year-3 month spread.

Figure 1: Ten year-three month term spreads, as of 7/27/2015 (blue bar). China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist accessed 7/27/2015, and author's calculations.

Interestingly, the US spread is larger than it was in April when I last examined the spreads, which seems to suggest that a US slowdown is not imminent. Of course, there is no guarantee that in an era of zero short rates, quantitative easing and (over an even longer period) foreign central bank purchases of long term Treasurys, the traditional correlation between spreads and growth (and recessions) hold. The only other country with a negative spread is Brazil.

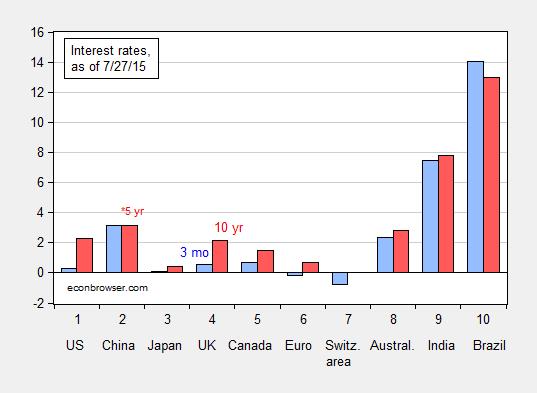

Since the levels of the short rate are also important for predicting recessions, as reported in just-published Chinn and Kucko (2015) (Table 6),I also present the underlying short and long rates in Figure 2.

Figure 2: Three month term interest rates (blue bar) and ten year interest rates (red bar), as of 7/27/2015 (blue bar). China long term observation is Five year interest rate. Euro ten year rate is for Germany. Source: Economist accessed 7/27/2015, and author's calculations.

Hence, while spreads are currently positive in most countries, short rates are also high, and particularly so in Australia, India and Brazil.

Now, shrinking spreads usually signal slower growth six to 12 months ahead, at least in the US context, so it could be that the spreads were signalling earlier the imminent recession. I don't off-hand have those spreads from six to 12 months ago, but I did record the spreads in April when I last examined the spreads, about three and a half months ago. Figure 3 repeats the relevant graph.