This information was originally sent to subscribers on Nov. 14, 2014.

Oil Market Conditions and Opportunities

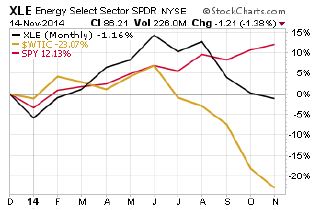

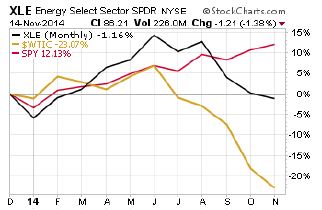

Oil prices are in a period of strong decline. That has hurt the prices of energy companies generally, as you see in the following chart.

West Texas Intermediate Crude (gold line) is down about 23% YTD, and that has flattened the return on the S&P 500 Energy Sector (black line) taking about 15% off its YTD total return.

Energy has underperformed the S&P 500 since the oil price broke.

A fundamental question is whether the break in oil and the underperformance of energy is an opportunity or a good way to lose money. We tend to think it is more of an opportunity (particularly in strong dividend-paying oil stocks), because of the logic for long-term continuing global demand growth and related oil price recovery.

Short-Term Bearish Oil Price View:

The u.s. Energy Information Administration reduced its 2015 average West Texas Crude price forecast to $77.75 from $94.58. The International Energy Agency reduced its 2015 Brent forecast to $83.42 from $101.67. JP Morgan, the most bearish of investment banks, cut its 2015 forecast for Brent crude to $82 from $115. Goldman Sachs reduced its 2015 West Texas Crude forecast from $90 to $75, and its Brent Crude forecast from $100 to $85. Vladimir Putin says his country may face a “catastrophic” drop in oil price, but will weather the storm. Saudi Arabia is increasing production to maintain its revenue, instead of cutting production to support the price of oil. This behavior is symptomatic of the current problem among oil export economies.

Long-Term Bullish Oil Price View:

In spite of various movements to stop using carbon-based fuels, there is still no good substitute for liquid fuels for transportation (that means oil and gas), and no alternative to oil and gas for petrochemicals production, which will continue. World population continues to grow, and oil consumption per capita in the developing world continues to grow. Oil prices are quite volatile and prone to geo-political price premia coming and going, but most of the large price drops have recovered in a year or two.