Big-tech behemoth Microsoft Corporation (MSFT) leapfrogged ExxonMobil Corporation (XOM) last week to become the second-largest company in the world by market cap. MSFT stock weighs in at a valuation of $405 billion compared to $402 billion for XOM stock.

Both still have a long way to go before catching up with apple Inc.'s (AAPL) world-leading $671 billion market cap, but the reversal is telling. Just a year ago, Exxon was considered the bluest of blue chips, and Microsoft was a tech dinosaur that had been left in the dust by Apple, Google (GOOG) and others. But today, with crude oil prices in freefall and with Microsoft resurgent under CEO Satya Nadella, MSFT stock has the momentum.

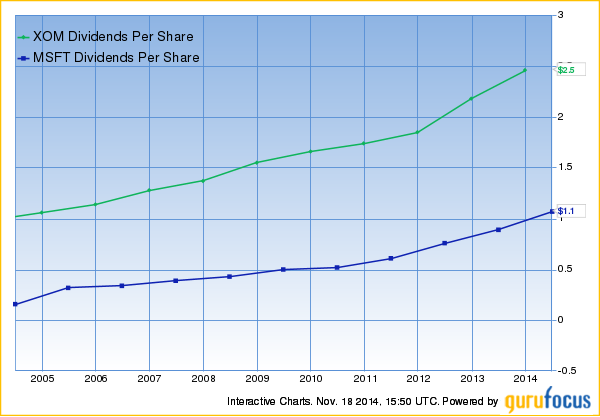

I'm actually bullish on both stocks. I've been long Microsoft for years, and I have indirect exposure to ExxonMobil via a position in the Energy Select SPDR ETF (XLE). Both stocks are monster dividend payers with long histories of rewarding their shareholders. Today, we're going to put Microsoft and ExxonMobil in the ring for a dividend smackdown. May the best dividend payer win!

Exxon Mobil Corporation

We'll start with ExxonMobil. XOM stock currently yields 2.8%. This isn't a monster payout by any stretch, but it is competitive in a world in which the 10-year Treasury yields a pitiful 2.3%.

ExxonMobil pays out only 33% of its earnings as dividends. So, come what may with the price of crude oil, there is still plenty of room for dividend growth in the years ahead. And indeed, ExxonMobil has been a serial dividend raiser over time, boosting its payout every year for the past 32 years. Over the past five years, it has raised its dividend at a 10.7% clip. Over the past ten years—a period that included the 2008 meltdown—it has raised its dividend at a 9.4% clip. That's not too shabby!

Let's take a look at one of my favorite metrics: Yield on cost. Yield on cost is the current annual dividend divided by your original purchase price. This is the cash return that you'd enjoy for buying and holding a dividend stock, and it's an important consideration for a stock like XOM with a modest current yield but a long history of dividend raising.