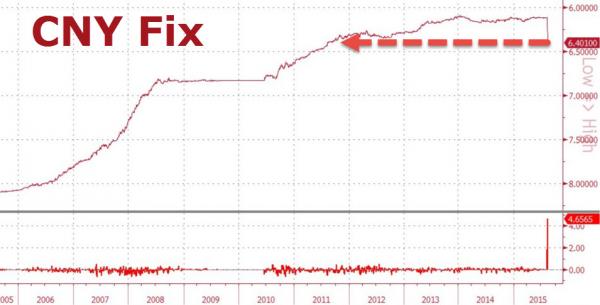

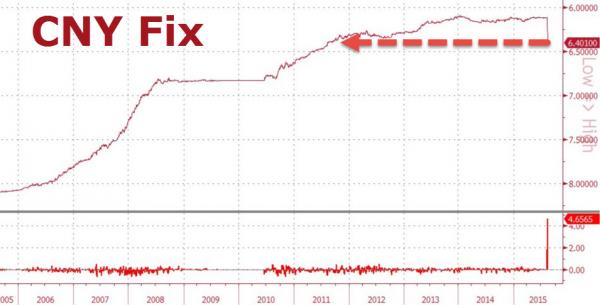

The “one-off” adjustment has now reached its 3rd day as The PBOC has now devalued the Yuan fix by 4.65% back to July 2011 lows.

The PBOC seeks to reassure…

Even before this evening's date with debasement history, Japan felt the need to step up the currency war rhetoric. Following disappointing Machine Orders data, Abe advisors Hamada warned that “Japan can offset Yuan devaluation by monetary easing,” and so the race to the bottom escalates. China has its own problems as BofAML's leading economic indicator showed “the foundation for a growth recovery is not solid, facing more downward pressure,” and while confusion reigns over why The PBOC would intervene at the close to strengthen the Yuan last night, the reality is the commitment isn't to a devaluation for China's exports, but undoubtedly its actions are directed toward trying to keep the wholesale finance interfaces somewhat orderly. Finally, China's devaluation couldn't come at a worse time for Argentina – about a quarter of the country's $33.7 billion of foreign reserves are now denominated in yuan, which suffered its biggest loss since 1994 on Tuesday.

Having devalued the (onshore) Yuan fix by 3.5% in the last 2 days, China did it again… shifting Yuan to 4 year lows

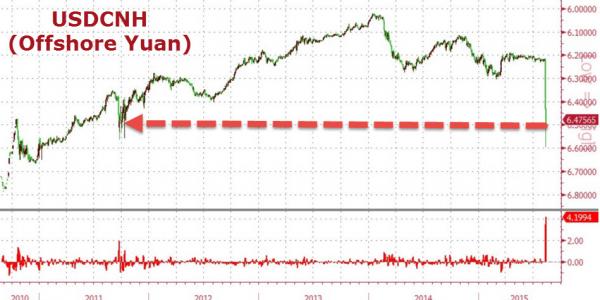

Offshore Yuan dropped back to 6.50…

And China Stocks have opened lower…