The Dow Jones Industrial Average has gone up 8 days in a row (using CLOSE $). What's unusual is that this is happening before the Dow has hit a new all-time high. These “up 8 consecutive days” events usually happen when the stock market is making new highs.

Here are the historical cases in which the Dow closed higher 8 days in a row, and what happened next to the stock market (Dow and S&P 500).

*This is a rather common event, so we're only looking at the historical cases in this current bull market, which began in March 2009.

*This is a SHORT TERM market study. The Dow going up 8 days in a row tells us nothing about what the stock market does during the medium-long term. It only tells us what the stock market will do next in the short term.

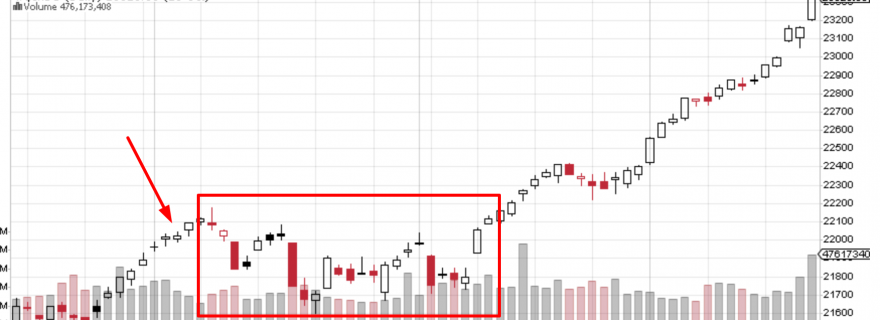

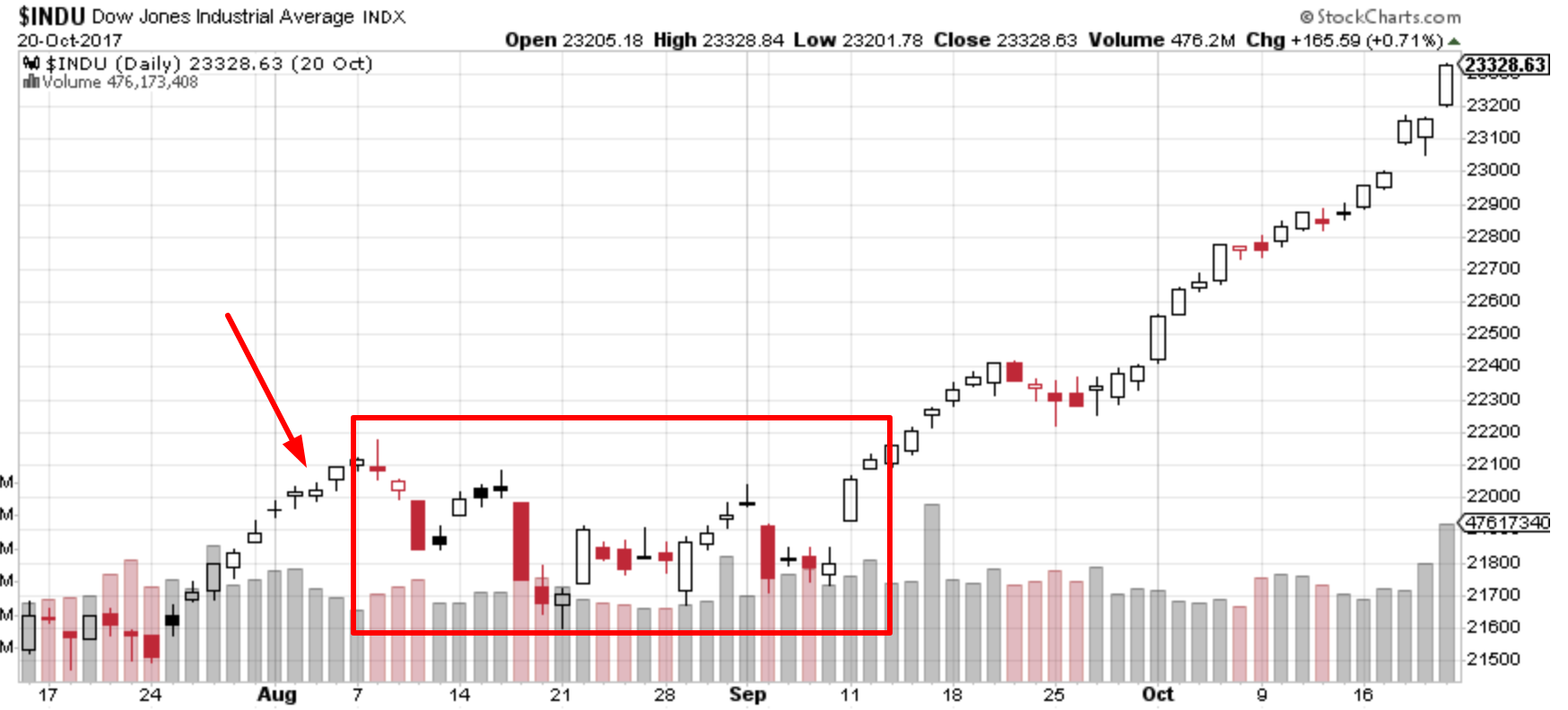

August 3, 2017 (ended up being 10 consecutive days)

The Dow ended up rallying 10 days in a row. It then made a pullback that lasted approximately 1 month. The S&P 500 did likewise.

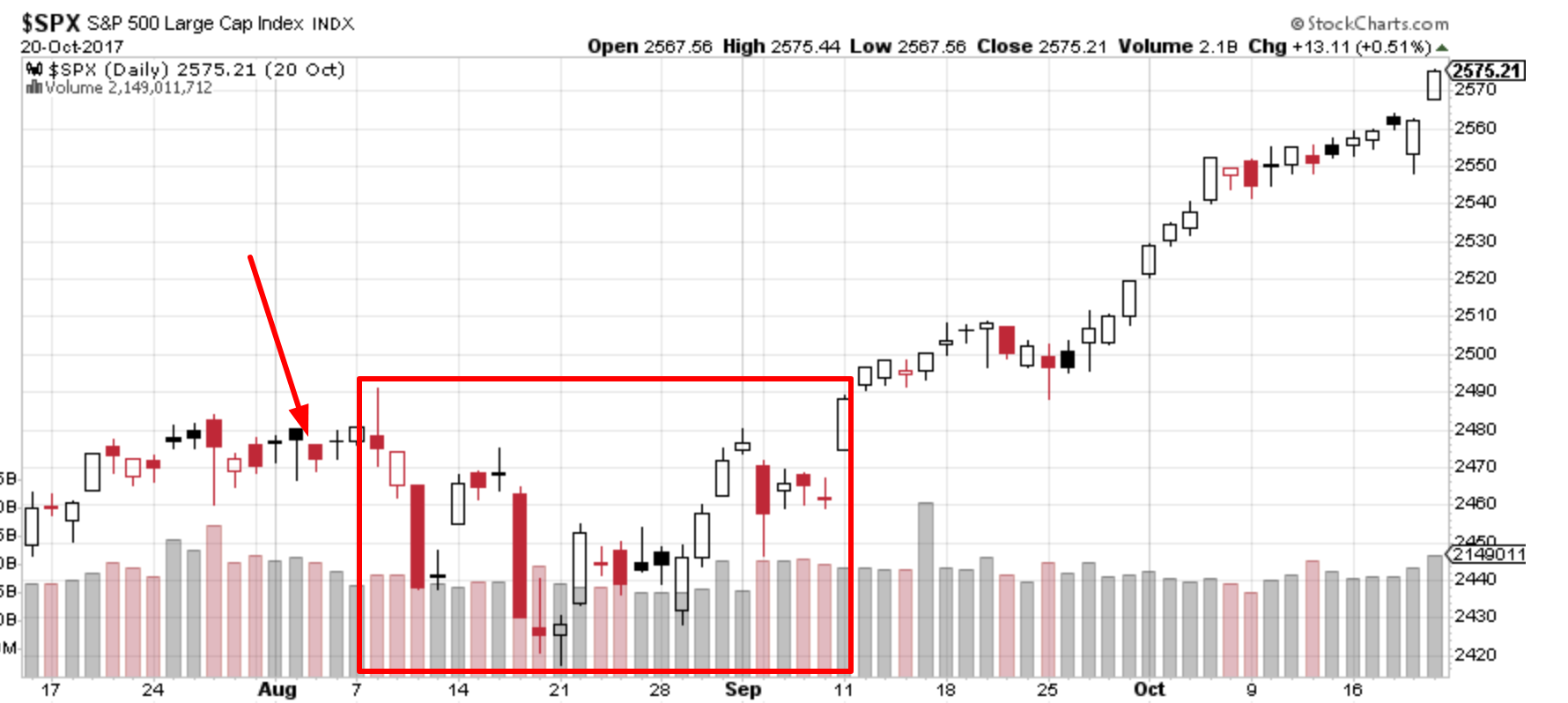

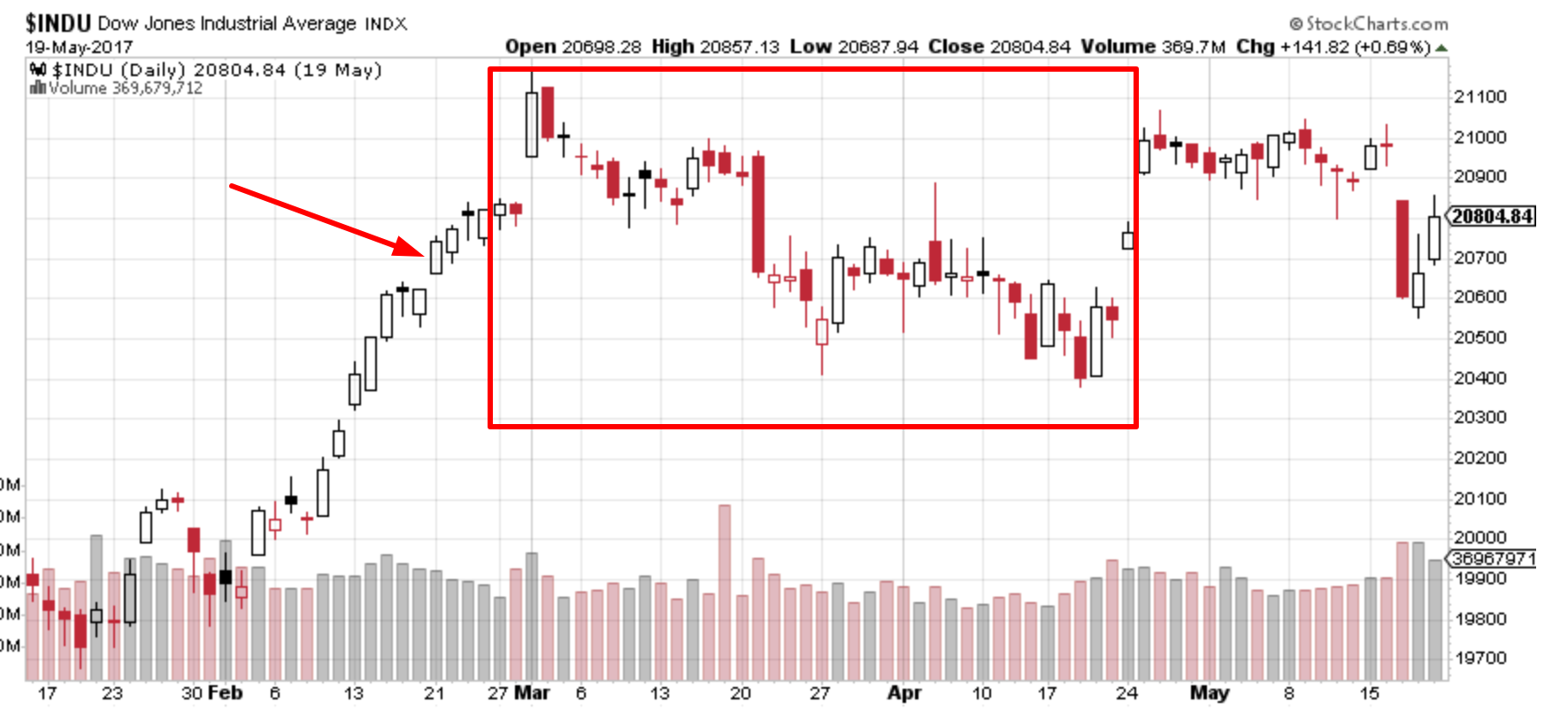

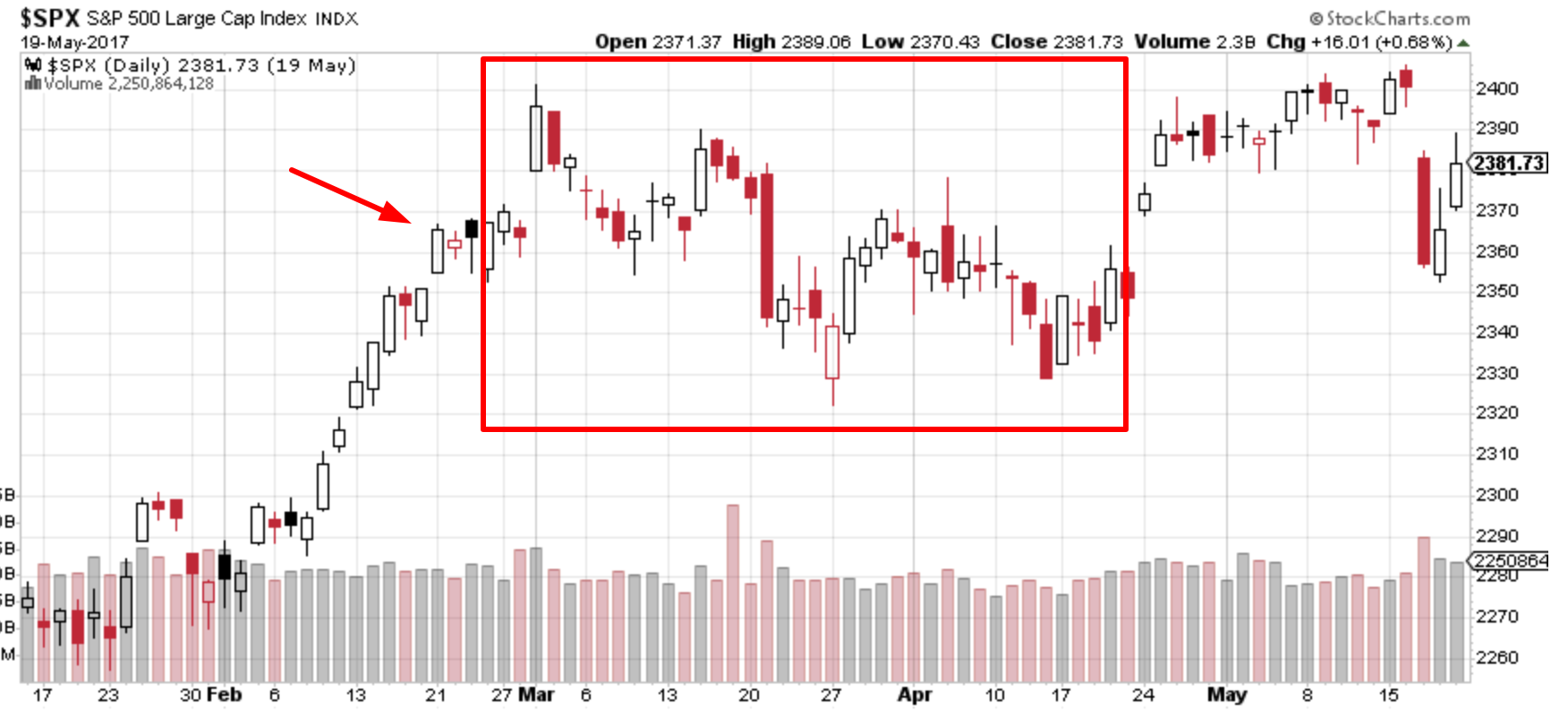

February 21, 2017 (ended up being 12 consecutive days)

The Dow ended up rallying 12 days in a row. It then made a pullback that lasted approximately 1.5 months. The S&P 500 did likewise.

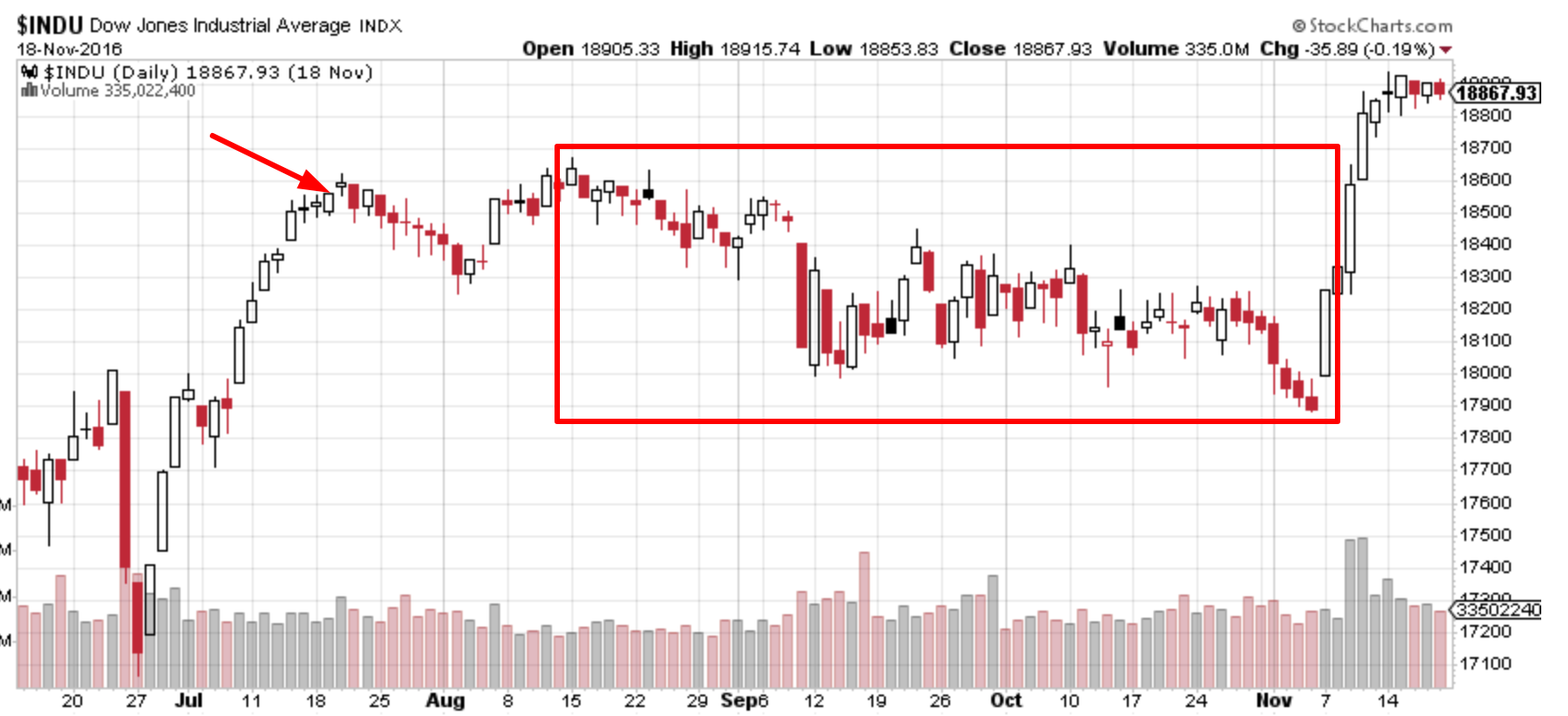

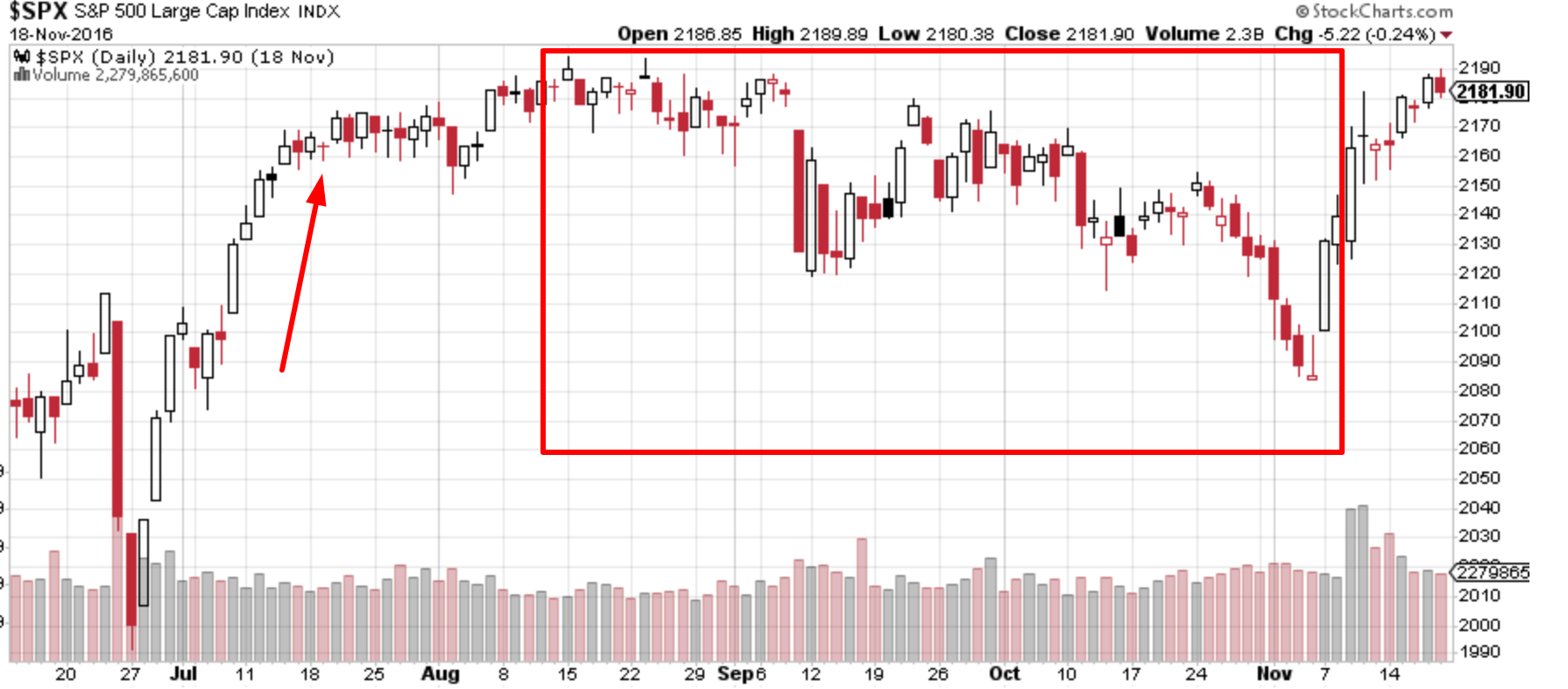

July 19, 2016 (ended up being 9 consecutive days)

Once this “8 days up” streak was broken, the Dow made a big pullback that lasted 3 months (this came close to being a “small correction”). The S&P 500 did likewise.

March 12, 2013 (ended up being 10 consecutive days)

The Dow ended up closing higher 10 days in a row. Then it consolidated sideways over the next month before trending higher. The uptrend was choppy. The S&P 500 did likewise.