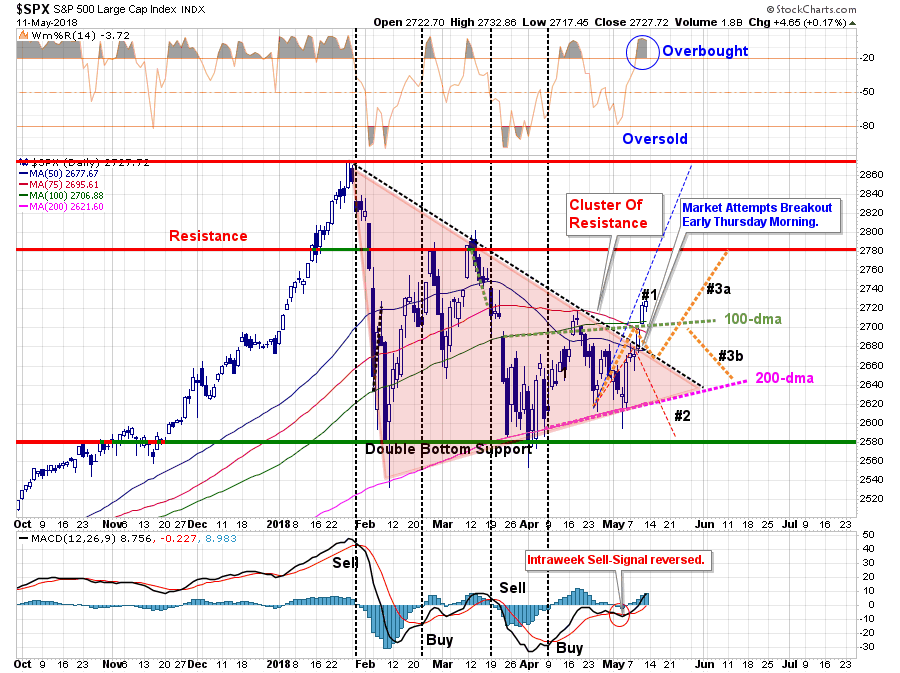

In this past weekend's newsletter, I updated our previous analysis for the breakout of the consolidation process which has been dragging on for the last couple of months. To wit:

“From a bullish perspective there are several points to consider:

- The short-term ‘sell signal' was quickly reversed with the breakout of the consolidation range.

- The break above the cluster of resistance (75 and 100-dma and closing high downtrend line) clears the way for an advance back to initial resistance at 2780.

- On an intermediate-term basis the “price compression” gives the market enough energy for a further advance.

With the market close on Friday, we do indeed have a confirmed breakout of the recent consolidation process. Therefore, as stated previously, we reallocated some of our cash back into the equity side of our portfolios.”

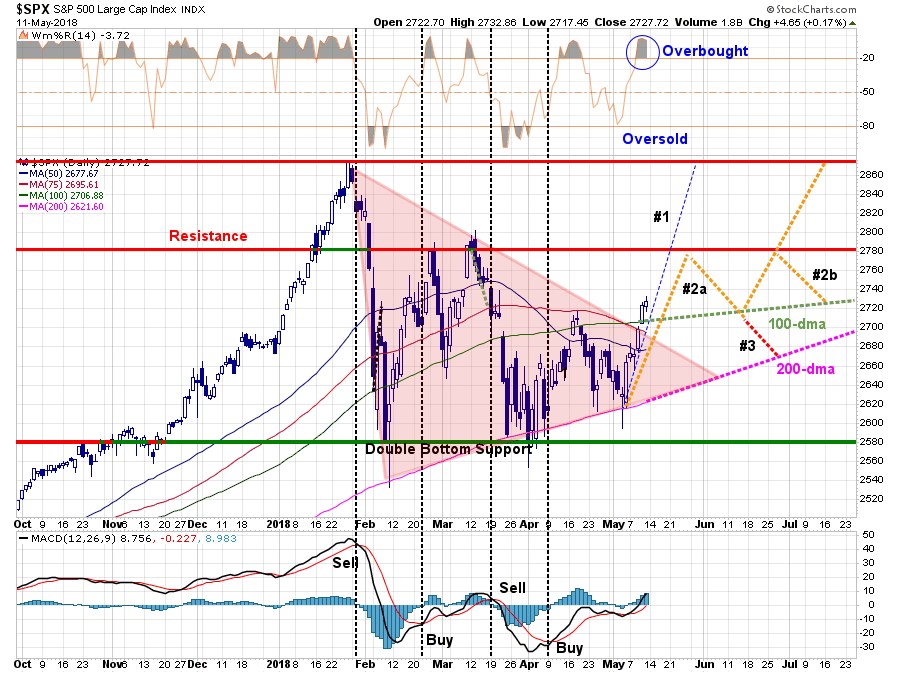

It's now time to make our next set of “guesstimates.”

With the market back to very short-term “overbought” territory, a bit of a pause is likely in order. We currently suspect, with complacency and bullish optimism quickly returning, a further short-term advance towards 2780 is likely.

Again, these are just “guesses” out of a multitude of potential variations in the future. The reality is that no one knows for sure where the market is heading next. These “pathways” are simply an “educated guess” upon which we can begin to make some portfolio management decisions related to allocations, risk controls, cash levels and positioning.