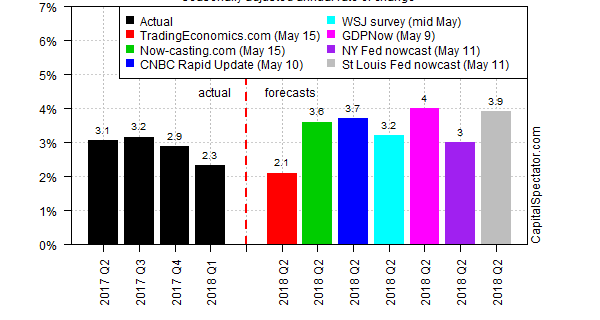

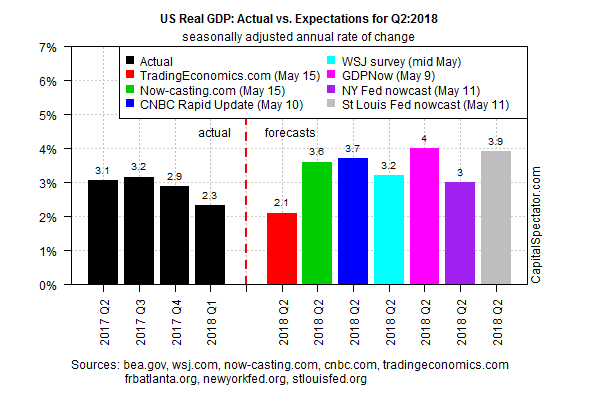

US GDP growth in the second quarter is on track to accelerate, based on the median estimate of several forecasts compiled by The Capital Spectator. If accurate, economic output is set to strengthen to a real 3.6% increase (seasonally adjusted annual rate) in Q2, a solid improvement over the subdued 2.3% increase reported for Q1.

One of the six forecasts calls for a slowdown in growth: TradingEconomics.com's outlook, which reflects a mix of macro modeling and analysts expectations, sees US growth dipping to a sluggish 2.1% in Q1. Otherwise, the remaining five projections in the chart below anticipate a solid rebound for the government's April-through-June GDP report that's scheduled for release in late-July. The Atlanta Fed's GDPNow model is currently posting the strongest projection at the moment: 4.0%, based on the May 9 update.

It's still early in the current quarter and so the estimates above are little more than preliminary guesstimates. The question, of course, is whether the rosy outlook will survive as new economic figures are published in the months ahead.

Several key updates scheduled for this week will provide an early reality check on the upbeat Q2 estimates, starting with today's April numbers on retail spending. Econoday.com's consensus forecast sees consumer spending rising 0.3%, down from a strong 0.6% in March. But that translates into a 4.5% year-over-year gain for retail sales through April, unchanged from the previous month and more or less middling relative to recent history. By that standard, the crowd's looking for a moderately healthy pace for consumer spending to prevail in today's update that's due later at 8:00 a.m. eastern.

Tomorrow's brings April updates on housing construction and industrial production. In both cases economists are expecting that a healthy rate of growth will endure, which implies that the upbeat projections for Q2 GDP growth will at least survive the week.