NEW ZEALAND DOLLAR TALKING POINTS

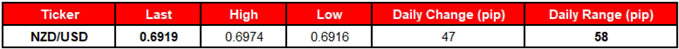

NZD/USD struggles to hold its ground as market participants digest the fresh developments coming out of the New Zealand economy, and the exchange rate appears to be on track to test the November-low (0.6780) as the bearish momentum appears to be gathering pace. With the Reserve Bank of New Zealand (RBNZ) interest rate decision out of the way, attention now turning to the annual budget statement as finance Minister Grant Robertson is scheduled to deliver the updates on May 17.

FINANCE MINISTER GRANT ROBERTSON TO DELIVER ANNUAL BUDGET STATEMENT

The administration under Prime Minister Jacinda Ardern is likely to reiterate its plan to further develop the Living Standards Framework (LSF) as officials focus on the promoting the wellbeing and living standard for households. The fiscal strategy is likely to reiterate that the economic outlook remains ‘supported by household income growth, continued population growth, low-interest rates and a terms of trade at record levels,' along with the Budget Responsibility Rules which are to:

With that said, more of the same from Mr. Robertson may do little to alter the near-term outlook for NZD/USD as the RBNZ remains in no rush to lift the cash rate off of the record-low, and recent price action raises the risk for a further decline in the exchange rate as bearish momentum from earlier this year appears to be reasserting itself.