EURO TALKING POINTS

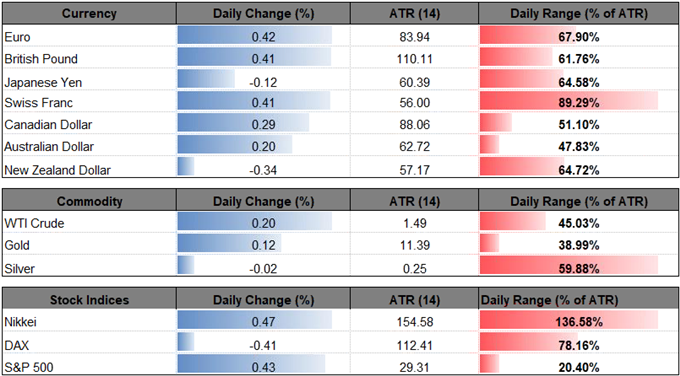

EUR/USD may stage a larger advance over the coming days as European Central Bank (ECB) officials show a greater willingness to move away from the easing-cycle. Recent price action raises for a more meaningful recovery as the exchange rate carves a fresh series of higher highs and lows, and the Euro may continue to outperform against most of its major counterparts as the Governing Council starts to alter the forward guidance for monetary policy.

EUROPEAN CENTRAL BANK (ECB) OFFICIAL SEES RATE-HIKE IN ‘SOME QUARTERS'

With the quantitative easing (QE) program set to expire in September, it seems as though the Governing Council will reveal a more detailed exit strategy over the coming months as board member Francois Villeroy de Galhau argues that it will be ‘some quarters, but not years' before the ECB removes the zero-interest rate policy (ZIRP). The comments suggest the central bank will continue to change its tune ahead of the next meeting on June 14 as President Mario Draghi and Co. are scheduled to speak over the coming days, and a growing number of ECB officials may look to alter the forward-guidance for monetary policy as ‘underlying inflation is set to strengthen, irrespective of short-run fluctuations in energy inflation.'

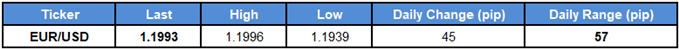

In turn, a batch of hawkish comments may fuel the rebound from the 2018-low (1.1822), with EUR/USD at risk for a larger recovery as the bearish momentum unravels.

EUR/USD DAILY CHART