Talking Points:

Fundamental forecast for GBP: Neutral

A roller-coaster ride for GBP over the last month ended on Thursday when the Bank of England kept all policy measures unchanged and downgraded growth and inflation expectations. MPC policy makers also tempered the outlook for rate hikes slightly noting that the costs to waiting for additional information were likely to be modest, ‘given the need for only limited tightening over the forecast period'. One month ago, expectations for a May rate hike ran as high as 82% while the latest expectations for the next 0.25% increase are now around 40% for August and 80% for November.

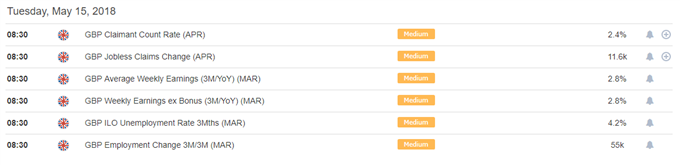

Looking ahead there is very little UK data released next week with only the monthly jobs and wages data on the slate Tuesday. A pick-up in wages and a reduction in the unemployment rate may give GBP a small boost, pointing towards future domestic inflation pressure although current expectations are in line with last month's figures.

The direction of GBPUSD ahead is also heavily reliant on the USD which has rallied strongly in the past few weeks and may still point to further cable weakness. Data releases are scarce also in the US next week though leaving both sides of the pair at risk of sentiment moves. The chart below shows that GBPUSD is now trading below its 200-day moving average – a bearish signal – although it is also worth noting that the RSI indicator is languishing in oversold territory.

GBPUSD PRICE CHART FOUR HOUR TIMEFRAME (JUNE 18, 2017 – MAY 11, 2018)

Traders of EURGBP will also need to tread slightly carefully next week as the currently weak EUR may get a boost from a raft of data released on Tuesday and Wednesday, especially the German inflation numbers.