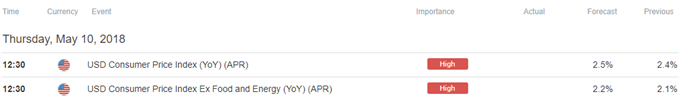

Another pick up in the headline and core U.S. Consumer Price Index (CPI) may fuel the recent decline in EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to adopt a more aggressive approach in normalizing monetary policy.

Signs of above-target price growth may push Chairman Jerome Powell and Co. to adjust the dot-plot at the next interest rate decision on June 13 as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,' and the committee may show a greater willingness to extend the hiking-cycle as the central bank largely achieves its dual mandate.

However, a series of below-forecast prints may generate a rebound in the euro-dollar rate as it saps bets for four rate-hikes in 2018, and Fed officials may continue to project a terminal benchmark interest rate of 2.75% to 3.00% as ‘the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.

IMPACT THAT THE U.S. CPI REPORT HAS HAD ON EUR/USD DURING THE LAST PRINT

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post-event )

Pips Change

(End of Day post-event)

MAR

2018

04/11/2018 12:30:00 GMT

2.4%

2.4%

-12

-18

March 2018 U.S. Consumer Price Index (CPI)

EUR/USD 5-Minute Chart

The U.S. Consumer Price Index (CPI) picked up for the second consecutive month in March, with the headline reading climbing to an annualized 2.4% from 2.2% the month prior, while core rate advanced to 2.1% from 1.8% during the same period to also meet market expectations. A deeper look at the report showed the cost for medical care increased 0.4% during the month, with the gauge for Housing climbing 0.3%, while prices for Transportation narrowed 1.2% on the back of easing energy prices.