Last week when I was not doing my own market positioning or writing subscriber updates, I was bringing Biiwii back to life, so on Friday I skipped the entirety of the Payrolls hype and never got to ISM either. So here's a post.

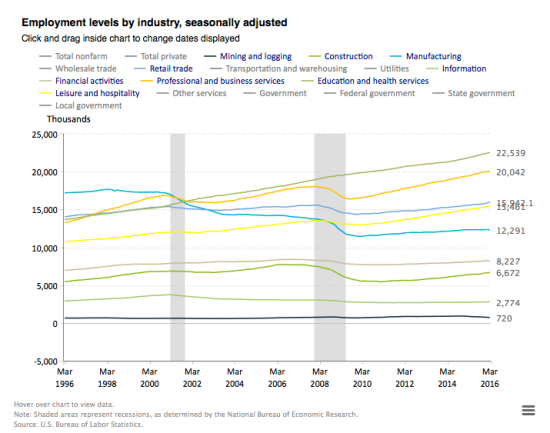

From BLS, a breakdown by industry of the +215,000 Payrolls data. No change here from recent trends. The economy continues to service itself with the top 4 lines being Education and Health Services, Professional and business Services, Retail Trade (services) and Leisure and Hospitality (services). Mining and Manufacturing continue to be bad and meh, respectively.

Interestingly, wage pressures are non-existent and that is probably what the market liked after the headline number was digested. Janet Yellen seems intent on promoting inflation and so far there is none in wages, both professional and hourly. From the St. Louis Fed by way of the Daily Shot, hourly earnings have been dropping.

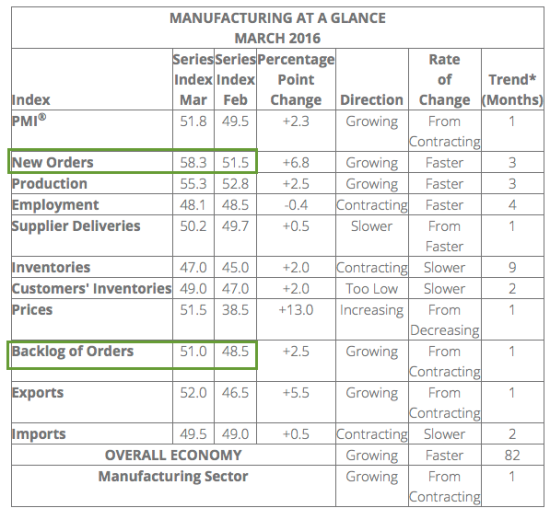

As for the ISM data, we projected manufacturing and export weakness long ago based on the strong US dollar. Currently, NFTRH is on a theme that if you are going to buy stocks, one of the areas to look at are manufacturers and exporters that have been beaten down over the last year. In line with this, the ISM did its part in popping last month.

The survey respondents sounded happy and the data backs them up. US Manufacturing is seeing a bounce.

Bottom Line of all of the above? The services economy is fine and inflation pressures are muting again (this is more in reference to the ‘inflation expectations' indicators we follow but also reflected in wages). The weakened currency is helping manufacturers and exporters (keep an eye on Q1 results in these areas).

I could insert the debt-to-GDP chart, but I'll keep this post a happy one for the optimists. The 103% Debt-to-GDP is a long-term negative and will need to be addressed one way or another. I think inflation will be a tool used by the Fed. Actually, the restrained inflation signals of late will help them in that operation.