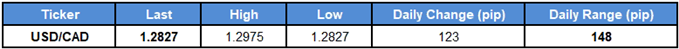

USD/CAD struggles to retain the advance from earlier this month, with the pair at risk for further losses following the failed attempt to test the 2018-high (1.3125). Meanwhile, EUR/USD extends the bearish sequence from earlier this year, with the Relative Strength Index (RSI) still flashing an extreme reading as the oscillator holds in oversold territory.

USD/CAD RATE OUTLOOK MIRED BY FAILED ATTEMPT TO TEST 2018-HIGH (1.3125)

The near-term advance in USD/CAD may continue to unravel following the failed attempt to test the 2018-high (1.3125), but fresh updates to the U.S. Consumer Price Index (CPI) may keep the pair afloat as both the headline and core reading are anticipated to pick up in April.

Even though Fed Fund Futures still show limited bets for four Fed rate-hikes in 2018, signs of heightening price pressures may boost the appeal of the greenback as it puts pressure on the Federal Open Market Committee (FOMC) to implement a more aggressive approach in normalizing monetary policy. A batch of positive developments may limit the downside risk for USD/CAD, with the pair at risk of facing range-bound conditions over the remainder of the week as Chairman Jerome Powell and Co. pledge to implement higher borrowing-costs over the coming months.

However, like the below-forecast print for the Producer Price Index (PPI), a dismal consumer price report may spark unfavorable conditions for the u.s. dollar,and USD/CAD may continue to pare the advance from the previous month as market participants scale back bets for an extended hiking-cycle.

USD/CAD DAILY CHART