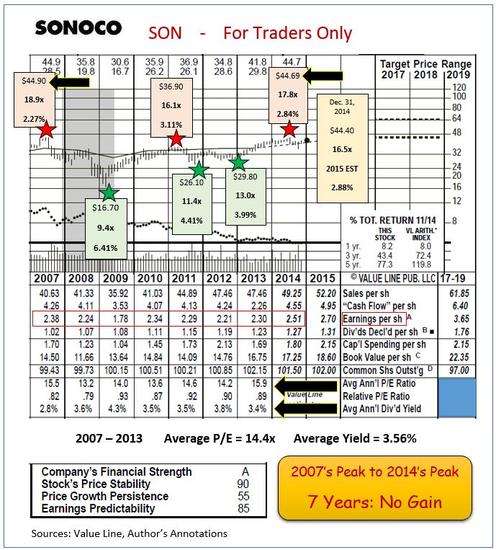

Recognizing ‘fair value' is the key to investing success. In Sonoco Products' case, investors should send its shares packing.

Many investors gravitate towards time-tested dividend growth stocks without understanding the value, or lack of value, that they may offer at various points in time.

Specialty packaging firm Sonoco Products (SON) meets the consistent dividend grower criteria but it has failed to deliver good results for buy and hold types.

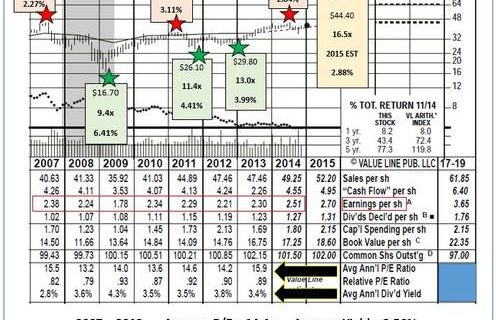

The firm continued paying and raising its yield, yet disappointed investors by showing no improvement in its fundamentals. 2013's EPS were slightly lower than they were six years earlier.

Sonoco appears likely to finally break through 2007's old peak EPS mark in the year ended Dec. 31, 2014.

SON shares topped out at $44.90 in 2007. They are closing out 2014 at about $44.40. Much revered Sonoco Products has produced less total return than a 7-year bank CD, purchased six years earlier, would have generated.

Avoiding that sub-par result would have been easy to do. In fact, SON offered some decent trading opportunities during those years. History majors had a big edge when playing with SON. They realized that the shares averaged a tad under 14.5x current year's EPS and typically yielded about 3.6%.

Buying when the valuation was clearly below those normalized levels led to excellent gains. The 2009 nadir presented a chance to more than double your principal in about a year, even on this stodgy company. The early 2013 low allowed for a 50% move to 2014's pinnacle.

Conversely, those who jumped into, or who refused to exit SON when it got pricey, have been stuck in what was essentially a bond substitute with about a 3.5% coupon.

Dividends were the gravy. The real money was made by buying low and selling high based strictly on valuation.

There is a very real place for stocks like these as part of well diversified portfolios, but only when the prices reflect discounts to historical averages for the same stock.