FUNDAMENTAL FORECAST FOR GBP: NEUTRAL NEXT WEEK'S RANGE: 1.3420-1.3770

GBPUSD Analysis and Talking Points:

GBPUSD SLIPS AMID WEAK UNDERLYING ECONOMY

Recent UK PMI surveys failed to show any meaningful rebound with the Services and Manufacturing PMI readings missing expectations, while collectively the PMI figures pointed towards Q2 growth at a sluggish 0.2%. As such, this suggests that the underlying UK economy remains somewhat fragile, which in turn led to further selling pressure in GBP, sitting just above the 1.35 level.

“SUPER THURSDAY” TO DICTATE GBP PRICE ACTION

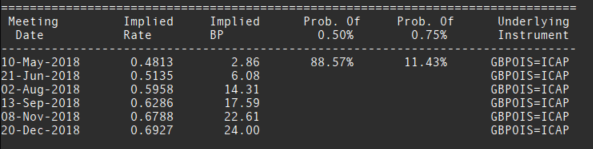

The main focus this upcoming week for GBP traders will be the Bank of England's Quarterly inflation Report. After a string of poor data and cautious comments from Governor Carney, a May rate hike has been taken off the table with marking pricing falling from 85% to 9%. As we look towards the meeting risks are somewhat skewed to the upside, on the basis that the BoE provide a “hawkish hold” through a possible 7-2 vote split (McCafferty and Saunders voting for a hike), while acknowledging the transition agreement between the UK and EU, alongside dismissing the softer data due to transitory factors, which in turn could boost expectations for a rate hike in August.

Subsequently, this would support GBP in the short term given that market pricing for a rate hike in the near future is subdued with 14bps priced in for the August QIR and a 25bps hike not fully priced in until Q119.

Source: Thomson Reuters

OVERALL WEEKLY OUTLOOK IS NEUTRAL

Although we remain neutral in GBPUSD this week, long term GBP bulls may find these levels attractive with the RSI at levels last seen since the October 2016 flash crash, which in turn could provide hopes of a modest reversal in the short-term. Additionally, the 1.3500 handle continues to offer support in the pair.