NFTRH 322 covered the usual range of markets, from US to global stocks to precious metals and commodities to currencies and indicators. It also included an extended economic discussion about the realities of the strong US economy and its dangerous underpinnings.

The economic segment began with this look at the Semiconductor Equipment sector, which was our first indicator on economic strength exactly 2 years ago and will be an initial indicator on economic deceleration when the time is right.

Excerpted from the December 21 edition of Notes From the Rabbit Hole, NFTRH 322:

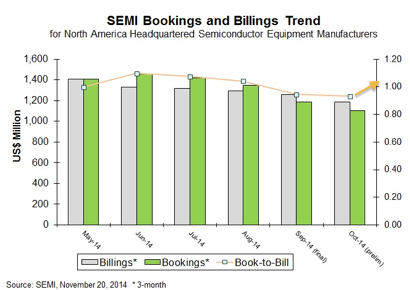

Checking the Semiconductor Book-to-Bill ratio (b2b), this all-important forward looker came in pretty decent for November. Per the data we reviewed in an update last week, the bookings, which is the most important component, was pretty good at $1.22 Billion compared to October's $1.1 Billion.

The graph from SEMI does not include the November data. I added an arrow showing the current level of the b2b.

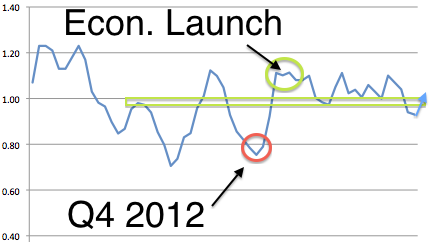

Our original graph is marked up as well to show the longer trend. There is a spike up happening and this may or may not be related to an overall year-end sales spike in some high end capital equipment that happens like clockwork at the end of each year in Machine Tools (ref. sales graph below). I do not have the level of knowledge about the Semiconductor Equipment industry to speak authoritatively about its more structural capital spending cycles. So this is just a possibility to consider.

Here is the data once again from EDA Industry Insight that pretty much allows us to set our clocks by the year-end Machine Tool (capital equipment) sales figures, which are due to tax considerations by fence sitting buyers. Machine Tools are so far doing exactly what we expected into year-end.

The bottom line on this exercise is that in order to forecast something negative for the economy (and hence the stock market, insofar as [the market] reflects the economy) we need to start seeing data degenerate in forward-looking items. The year-end period is stable and the back-lookers like ‘jobs', GDP, etc. are just fine. We will head into 2015 as always, watching what is happening, not what we project in our minds to be happening.