Econintersect's Economic Index declined to the lowest level since April 2010. The tracked sectors of the economy remain relatively soft with most expanding at the lower end of the range seen since the end of the Great Recession. Our economic index has been in a long term decline since late 2014.

Our employment six month forecast discussed below continues to forecast relatively strong employment growth, but the current forecast is for a slower rate of growth.

This post will summarize the:

Special Indicators:

The consumer is still consuming. The ratio of spending to income has recently declined under 0.92 – but has been elevated since Jan 2013. There has been only four periods in history where the ratio of spending to income has exceeded 0.92 (April 1987, the months surrounding the 2001 recession, from September 2004 to the beginning of the 2007 Great Recession, and for some occasions since late 2013). A high ratio of spending to income acts as a constraint to any major expansion in consumer spending.

Seasonally Adjusted Spending's Ratio to Income (a increasing ratio means Consumer is spending more of Income)

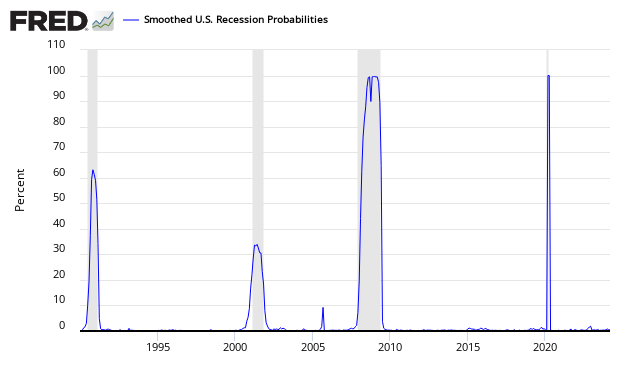

The St. Louis Fed produces a Smoothed U.S. Recession Probabilities Chart which is currently giving no indication of a recession.

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. This model was originally developed in Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

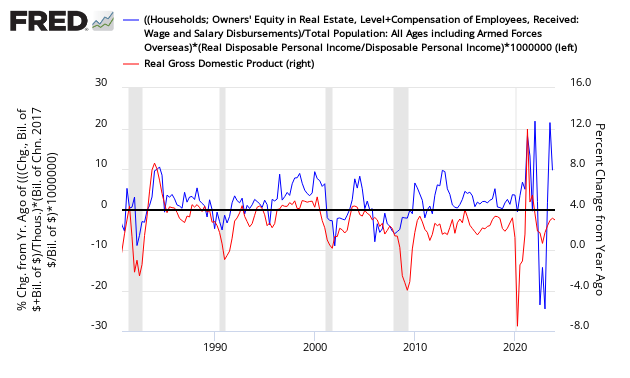

Joe Sixpack's economic position is better than the previous period (blue line in graph below). The Econintersect index's underlying principle is to estimate how well off Joe feels. The index was documented at a bottom in the July 2012 forecast. Joe and his richer friends are the economic drivers. Joe's position is above levels associated with past recessions. However, note that this index has falsely warned of recessions that never occurred – but its purpose is not to foresee recession, but to indicate stress on the consuming class. This index is updated every quarter. It could also be said that GDP has divorced itself from Joe Sixpack.

Joe Sixpack Index (blue line, left axis):

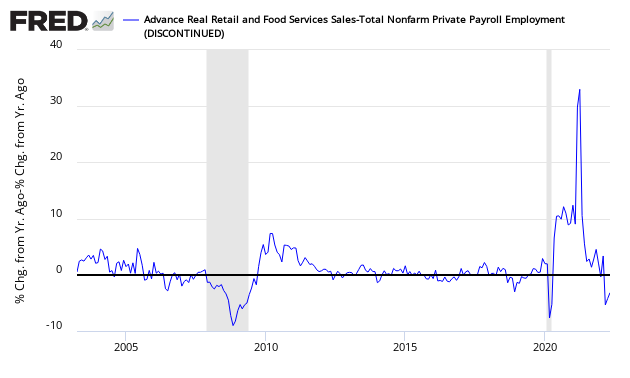

Econintersect reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales.This index is currently negative. When retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. However, this index has many false alarms.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero suggests economic expansion

The growth rate of real gross domestic product (GDP) is the headline view of economic activity, but the official estimate is released with a delay. Atlanta's Fed GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release. Econintersect does not believe GDP is a good tool to view what is happening at Main Street level – but there are some correlations. In the previous 30 days, GDPnow is showing a relatively stable rate of growth (neither accelerating or decelerating).