The headlines say the durable goods new orders declined. Our analysis agrees – and everything seemed soft.

Econintersect Analysis:

unadjusted new orders growth decelerated 7.1% (after accelerating a revised 0.6% the previous month) month-over-month , and is down 1.4% year-over-year.

the three month rolling average for unadjusted new orders decelerated 2.7% month-over-month, and up 3.2% year-over-year.

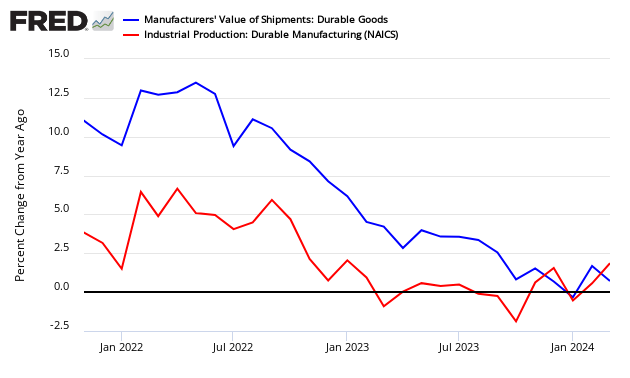

Year-over-Year Change of 3 Month Rolling Average – Unadjusted (blue line) and Inflation Adjusted (red line)

Inflation adjusted but otherwise unadjusted new orders are down 2.9% year-over-year.

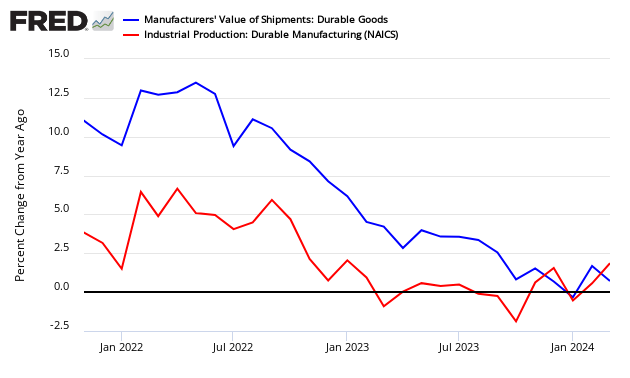

The Federal Reserve's Durable Goods Industrial Production Index (seasonally adjusted) growth accelerated 1.1% month-over-month, up 5.7% year-over-year [note that this is a series with moderate backward revision – and it uses production as a pulse point (not new orders or shipments)] – three month trend is accelerating.

Comparing Seasonally Adjusted Durable Goods Shipments (blue line) to Industrial Production Durable Goods (red line)

unadjusted backlog (unfilled orders) growth decelerated 1.0% month-over-month, up 12.4% year-over-year.

according to the seasonally adjusted data, the major force on the data was the increase in defense aircraft. Most other areas declined marginally month-over-month.

note this is labelled as an advance report – however, backward revisions historically are relatively slight.

Census Headlines:

new orders down 0.7% month-over-month.

backlog (unfilled orders) was up 0.4% month-over-month – and remains at a historical high.

the market expected:

| |

Consensus Range |

Consensus |

Actual |

| New Orders – M/M change |

0.5 % to 8.0 % |

+3.1 % |

-0.7% |

| Ex-transportation – M/M |

0.3 % to 3.0 % |

+1.3 % |

-0.4 % |