We suspect more than a few are feeling like this after today…

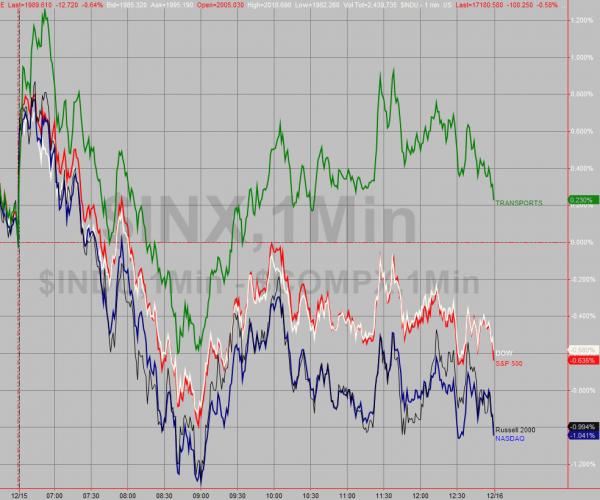

What started out exuberant – with proclamations that oil and stocks had found a bottom – ended badly…

Apart from JPY – which was bid almost 1% against the USD – everything was sold today… Treasury yields up 6bps at the short-end, Oil down over 4% after being up over 1% overnight, gold & silver hammered down 4%, stocks plunged (though Trannies bounced back), credit smashed wider, EM FX crushed, Russian “everything” demolished, and

With 10 minutes to go, They got serious and broke the markets to try andget something positive out ofthe day…

From Friday's close – quite a roller-coaster for futures…

And Cash equities…

The S&P 500 broke its 50DMA and 100DMA, finding brief support at both…

Russell 2000 notably in the red YTD now…

Credit markets were crushed today…

*S&P/LSTA u.s. LEV LOAN 100 INDEX BID PRICE: 94.5386, -.4373

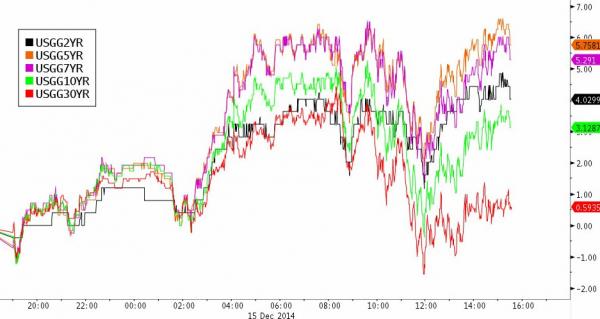

Treasury yields closed higher on the day – major flattening

FX markets showed very modest USD strength but the drop in USDJPY was the most notable… (strength in JPY)

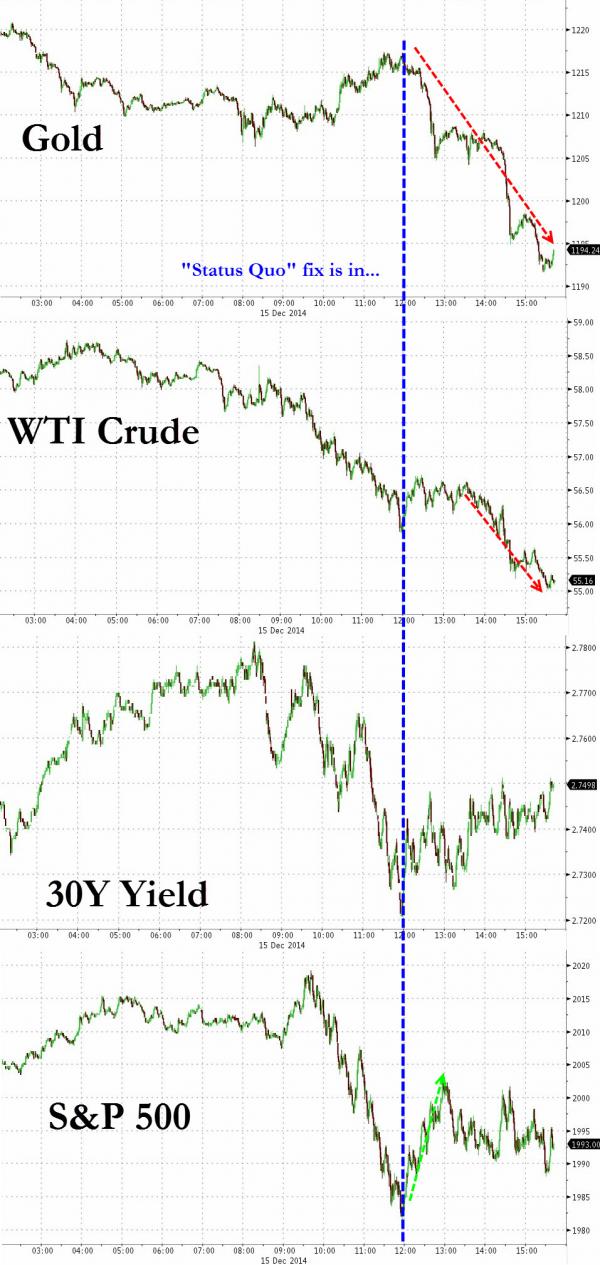

And last but absolutely not least – commodities were absolutely crushed… PMs and oil…

Close-up on Crude..

And Oil & Silver started to get slammed as the S&P was lifted… It seems between $56 oil and 12ET, the fix was in to save the status quo… but it didn't create the magic…

and then there's Russia…

Charts: Bloomberg