A Federal Reserve data release (Z.1 Flow of Funds) for 3Q2014 – which provides insight into the finances of the average household – shows a marginal decline in average household net worth. Our modeled “Joe Sixpack” – who owns a house and has a job, and essentially no other asset – is also feeling poorer.

You may ask why this analysis is important? It looks at the financial health of the consumer – and in a consumption based economy, it measures the dynamics affecting the consumer.

What is concerning is that the 35% of Americans who have no home or assets are no better off (living from paycheck to paycheck) – and have no path to consume more. This person is not modeled by this index.

First, from the Z.1 Flow of Funds report, what was shown about Household Net Worth and Growth of Domestic Nonfinancial debt. Cumulative Household net worth declined marginally, while cumulative household debt grew.

The Joe Sixpack Index

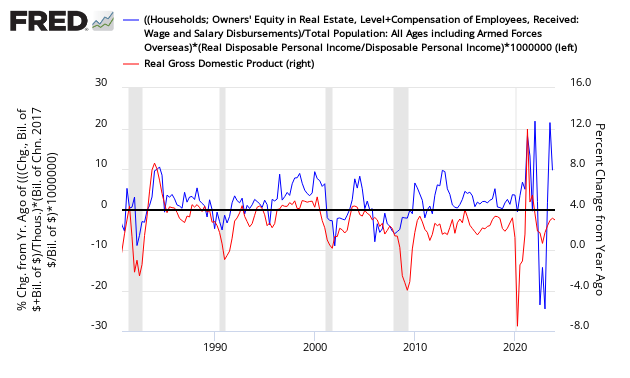

The Joe Sixpack Index is a composite index of home prices and wage income (again – Joe owns a house, has a job, and no other assets). This index was designed to measure how rich Joe should feel. The theory is that the richer Joe feels, the more Joe will spend.

Joe Sixpack Index (blue line, left axis) shown against GDP (red line, right axis)

The Middle Man Index

The middle class household with financial assets and real estate assets is Middle Man. A Federal Reserve Publication shows the percentage of households owning various financial assets. Other than real estate, Middle Man holds transaction accounts (checking – 1% of all financial assets) and retirement accounts (roughly estimated by Econintersect at 25% of household financial assets).