Our core market health indicators are mostly improving this week, but at a very slow pace. None of them have improved enough to change any of our portfolio allocations. It isn't likely that conditions will change by Friday, but I'll make a post if they do.

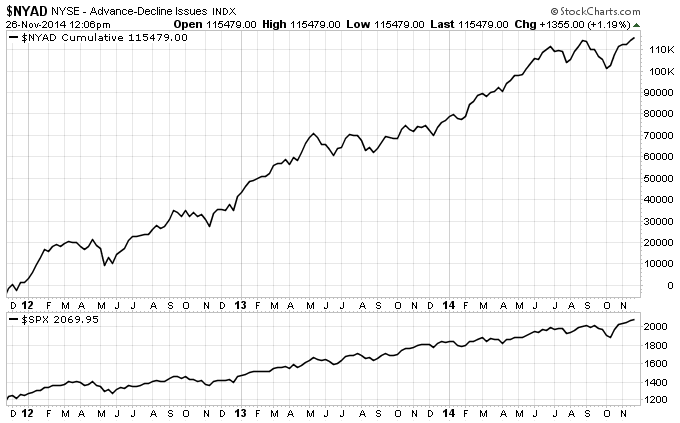

One positive sign is the NYSE cumulative Advance / Decline line (NYAD) has finally cleared its negative divergence with price. It's still lagging a bit so I'd like to see more strength from this indicator. Especially on the next dip…if we get one.