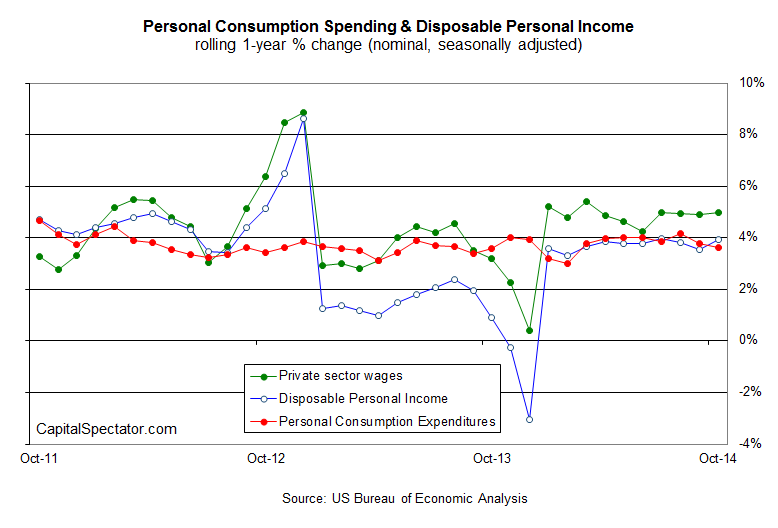

Personal income and spending posted modest gains in today's October update from the US Bureau of Economic Analysis (BEA), albeit at monthly rates (+0.2% on both counts) that fell short of the crowd's expectations. The usual suspects will fuss over the monthly comparisons and try to spin context out of noise with the data, but there's more than one way to slice and dice the numbers. As an antidote to the standard routine, let's focus on the annual trend for what is arguably the more relevant data set in today's report: private-sector wages, which continue to rise at an encouraging and stable rate of roughly 5%.

It's hard to overestimate the value of private-sector wage growth, or the lack thereof, in the search for clues about the big-picture trend. Here, after all, is the primary source of financing behind the lion's share of US economic activity — consumer spending. It doesn't take a Ph.D. to recognize that the macro outlook suffers if wage growth is decelerating or, worse, falling. But based on today's BEA update, wage growth remains fairly stable and, compared with recent history, rising at a decent rate.

Private wages advanced 5.0% for the year through October, inching up to the best annual comparison since July, which is to say close to the peak rate since January 2013. There's been a lot of discussion lately about the lack of real (inflation-adjusted) growth in wages, and rightly so. But there are signs that upward pressures on wages may be picking up. The employment Cost Index for the US rose 0.7% in the second quarter—the most in over five years, based on the the 3-month period ending September 2014. That's hardly a definitive sign, but it supports the case that today's news of a stable and relatively robust annual increase in private wages (in nominal terms) is a sign of things to come.

The joker in the deck is the labor market, of course, and today's news of an unexpected spike in jobless claims for last week raises new questions. But jobless claims are notoriously volatile in the short run and so it's premature to assume that this year's downward bias in new filings for unemployment benefits has run its course.