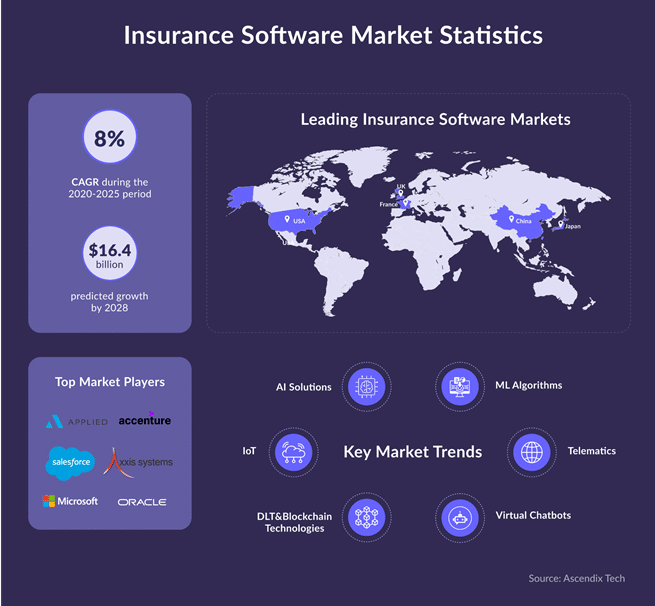

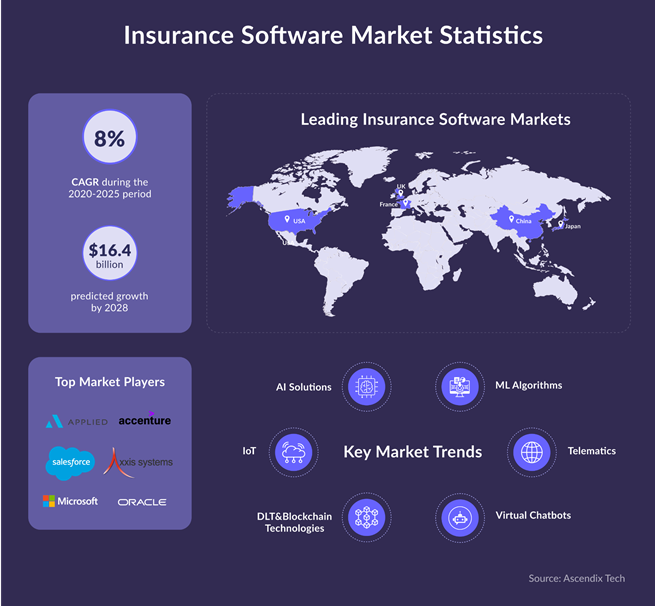

With the rising demand for insurance services in developing countries, the insurance software market is projected to experience substantial growth of $16.4 billion by 2028. It becomes evident that in the fast-paced insurance industry, staying ahead of the competition demands embracing cutting edge technology. By leveraging custom insurance software development services, companies can distinguish themselves within the competitive landscape. They achieve this by either enhancing their existing insurance applications or creating new ones, all while incorporating personalized configurations such as advanced big data analytics.Geniusee provides insurance software development to help you become a leader in the market. Wondering how to make the right choice among various tech vendors? Keep reading and find out how teaming up with a reputable insurance software development company can foster innovation and success in the industry. See what features and competencies a company should have to deliver high-quality software solutions for your business.What is going on in the insurance software market?The global market size for property and casualty insurance was assessed to be over $9 billion in 2020. Predictions from Verified Market Research indicate that this figure is projected to almost double by 2028, showing a Compound Annual Growth Rate (CAGR) of 7.5% during the period spanning from 2020 to 2028.The rapid growth of the software development market is no surprise considering the latest technologies, including cloud technology, Machine Learning, IoT, Blockchain, Virtual Chatbots, and AI solutions. These innovative approaches are anticipated to fuel even more the growth of this particular segment.In line with this, a report from Technavio highlights the notable development of insurance software markets in critical regions. Specifically, North America (focusing on the US), Japan, the UK, China, and France have been identified as swiftly emerging markets in this domain.

Picture credits: original7 Effective strategies to choose the ideal insurance software development companyFinding the perfect insurance software development company can be challenging for your business. Want to ensure you make the right choice? Consider these essential strategies we highlighted below:Establish clear selection criteriaWhen considering the selection process, it's essential to set specific criteria that hold significance for your unique case. See below a list that outlines some prevalent factors to take into account:

Picture credits: original7 Effective strategies to choose the ideal insurance software development companyFinding the perfect insurance software development company can be challenging for your business. Want to ensure you make the right choice? Consider these essential strategies we highlighted below:Establish clear selection criteriaWhen considering the selection process, it's essential to set specific criteria that hold significance for your unique case. See below a list that outlines some prevalent factors to take into account:

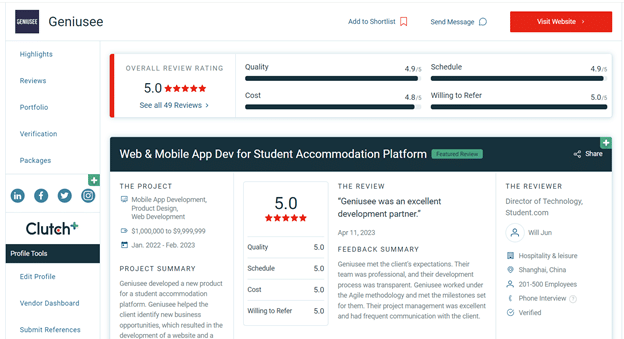

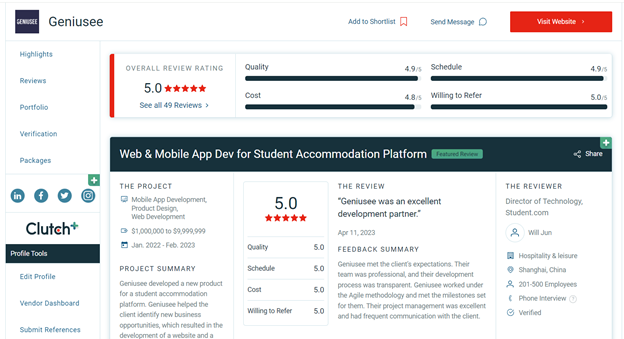

Do your researchConduct a thorough online search and review companies with strong portfolios specializing in the type of software you need. Cutting corners in the research phase may lead to future complications, such as wasted resources and a poorly functioning software system. investing time in research can save you from headaches down the road.Check rankings and reviewsStart by exploring rankings and reviews from reliable sources like linkedin, G2, Good Firms and Clutch. Feedback from previous and current clients can provide valuable insights into the company's expertise, service quality, and customer satisfaction levels. Positive reviews highlight strengths, while negative ones reveal areas for improvement.

Photo credits: originalAsk for referralsSeeking referrals from your network is undoubtedly an intelligent move. Firsthand experiences shared by others who have invested in software development can give you a clear picture of the company's efficiency, communication, and overall performance. Referrals save time and help you build a shortlist of promising candidates.Inquire about a vendor's development processEnsure the company's development process aligns with your specific software requirements. Look for industry-specific coding standards, robust testing protocols, and a well-structured project management system. A transparent development process will lead to efficient and effective software delivery, minimizing misunderstandings.Evaluate vendor's experienceThe company's experience in insurance-related software projects matters. Assess their expertise and understanding of the insurance industry, directly impacting the software's quality. A focus on your specific needs will be a significant advantage. Take the time to understand their capabilities to make an informed decision.Check vendor's proficiency in solution developmentA crucial aspect of successful outsourcing is selecting a tech partner with a strong track record in delivering intricate software solutions. Seek out vendors who offer comprehensive end-to-end development services, including:

Photo credits: originalAsk for referralsSeeking referrals from your network is undoubtedly an intelligent move. Firsthand experiences shared by others who have invested in software development can give you a clear picture of the company's efficiency, communication, and overall performance. Referrals save time and help you build a shortlist of promising candidates.Inquire about a vendor's development processEnsure the company's development process aligns with your specific software requirements. Look for industry-specific coding standards, robust testing protocols, and a well-structured project management system. A transparent development process will lead to efficient and effective software delivery, minimizing misunderstandings.Evaluate vendor's experienceThe company's experience in insurance-related software projects matters. Assess their expertise and understanding of the insurance industry, directly impacting the software's quality. A focus on your specific needs will be a significant advantage. Take the time to understand their capabilities to make an informed decision.Check vendor's proficiency in solution developmentA crucial aspect of successful outsourcing is selecting a tech partner with a strong track record in delivering intricate software solutions. Seek out vendors who offer comprehensive end-to-end development services, including:

Remember, the choice of an insurance software development company is a crucial decision with long-term implications for your business. By considering factors like experience, development processes, rankings and reviews, and referrals, you can narrow down your options and find the best fit for your specific needs. But if you do not want to waste your time searching, Geniusee is here to deliver tailored software solutions in time and within a prescribed budget. Based on our extensive experience and innovative approaches, our developers will help you stand out in the insurance market!