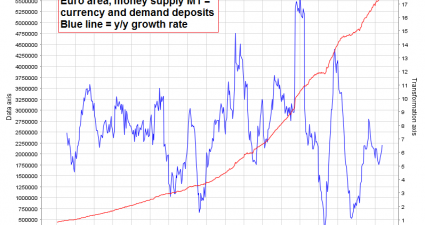

Euro Area Money Supply And Credit Growth

Money Supply Growth Accelerates, Credit to Private Sector Still in Decline While money supply growth is slowing down in the US, it has recently continued to accelerate somewhat in the euro area. The effects of the ECB’s “QE”-type debt monetization activities in the form of covered bond and ABS purchases have not yet impacted aggregate…