This Week In Stocks – July 1

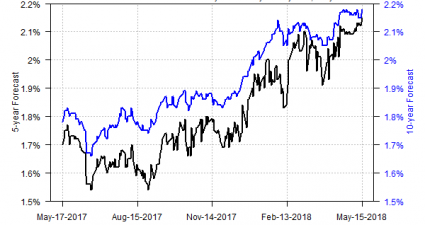

Our analysis of the S&P 500 is for stocks to continue their move lower. We believe that the SPX is in the declining phase of its current market cycle. It will likely continue this move, with 2670 as as a conservative projection. A break below the 2677 level would be a break below where SPX…