Finance

Peter Schiff: Fed Has Been “Bluffing,” No Rate Hike I

Appearing on Yahoo! Finance, Peter Schiff underscored that the Federal Reserve has been bluffing about raising interest rates. In fact, they will continue to bluff for as long as possible until they’re forced to deal with a deflating asset bubble. He also pointed out the arbitrariness of the Fed’s supposed goal posts: previously they had said…

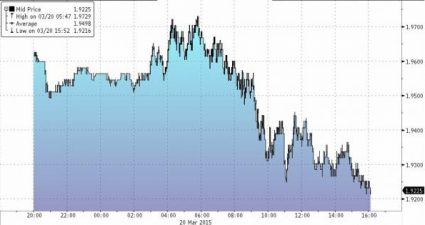

Dollar Strength Is Coming To An End?

Welcome to the beginning of the end of dollar strength. I say that because of what the Federal Reserve told the world this week. As expected, the Fed removed the word “patience” from the official policy language it has been using for years to describe its approach to timing America’s first interest-rate increase in nearly…

SP 500 And NDX Futures Daily Charts – Bubble On

Bubble on. Have a pleasant weekend.

Quad-Witching Thriller: Oil, S&P, Nasdaq Soar As Bond Yields

The only asset class that made any sense in today’s quad-witching was the 10 Year, whose yield did precisely what it should do in a world in which the Fed slashed the economic outlook 2 days ago: it tumbled. The 10Y is almost back to the “kneejerk” shock levels following Yellen’s dramatic slashing of the…

Oil’s Plunge Cools Off Energy Hot Spot

TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence. Not too long ago, if you asked any energy insider where in the world the most exciting energy hot spot was, you would have gotten a surprising answer: Africa. It’s true; Africa was a…

These Markets Are “Extreme Bargains” Right Now

Dear Diary, The big news this week was that the Fed dropped its pledge to be “patient” in raising interest rates. The Fed wants to get the market used to the idea of higher rates sometime in the not so distant future. But just so you are clear on how valuable this “forward guidance” is,…

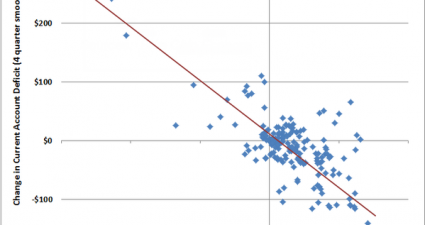

Yield Curve, Futures, Suggest No Rate Hike Until December; GDP Fo

Curve Watchers Anonymous is investigating the yield curve following Janet Yellen’s exceptionally dovish FOMC announcement on Wednesday. Yield Curve 2-yr, 3-yr, 5-yr, 10-yr, 30-yr 30-year in black and red 10-year in orange 5-year in blue 3-year in green 2-year in purple Change From Year Ago Above rate table from Bloomberg. Futures Suggest No Rate Hike…

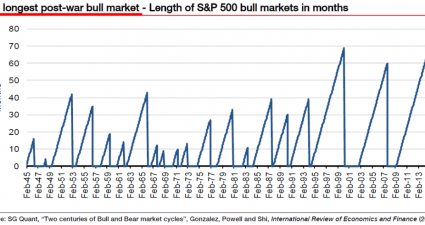

The Longest Post-War Bull Market

by Christopher Pavese, The View from the Blue Ridge. A few more thoughts on recognizing where we are in the cycle, illustrated by SG: The US has now “enjoyed” its longest bull market since WWII. Over this period, the S&P gained over 200%, making it the third-strongest six-year run since 1900. The two others, 1929…