Finance

EC Dollar: Tre

One of the most basic but important questions traders have to ask themselves is whether the market they are looking at is trending or moving sideways. The tactics and tools vary according to the answer. The turn of the calendar–a new marking period begins–offers an opportunity to look afresh at the price action. What makes a review…

The Correction Continues

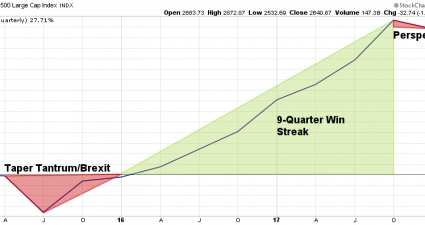

First, the good news. Despite all of the volatility over the last two months, a seemingly brutal quarter for investors came to an end with a staggering loss on the S&P 500 of -1.22% or about -0.76% including dividends. I know, it’s horrible. After all, the S&P 500 just broke a 9-quarter straight winning streak which…

E

“The discount on the Canadian effective price (CEP) vis-à-vis WTI has risen to over US$20, more than double its 2017 average (US$9.61). Futures contracts currently suggest that the differential between WTI and the CEP will narrow to the US$15 range by the summer, in line with a return to full capacity of the TransCanada Keystone…

SPX Could Retrace Two-Year Rally

VIX pulled back from a test of its March 2 high at 26.22 a week ago, closing above Short-term support at 18.83. The next probe higher may exceed the prior high in the next 1-2 weeks. (Bloomberg) The prime suspects in last month’s global rout may be at it again. Inverse exchange-traded funds — which…

Quick Take: GDP Linked Bonds?

There is a core concept in finance that states that an investor should be properly compensated for the amount of risk taken. While central banks have certainly distorted the amount of compensation per degree of risk, the axiom still holds true. It is in this light that we recently read an article entitled GDP-linked bonds could…

The Simple Reason Why Steel Tariffs Will Destroy More Jobs Than T

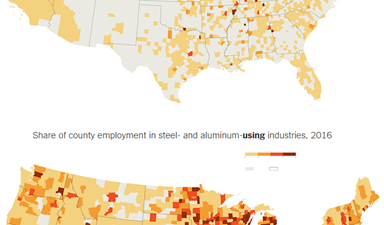

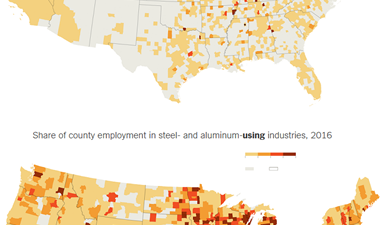

The US maps below show: a) the share of each US county’s employment in steel- and aluminum-producing industries in 2016 (top map) and b) the share of each US county’s employment in steel- and aluminum-using industries (bottom map). The maps were featured in a recent New York Times article titled “How Trump’s Protectionism Could Backfire.” Here’s a slice: Tupelo…

The Simple Reason Why Steel Tariffs Will Destroy More Jobs Than T

The US maps below show: a) the share of each US county’s employment in steel- and aluminum-producing industries in 2016 (top map) and b) the share of each US county’s employment in steel- and aluminum-using industries (bottom map). The maps were featured in a recent New York Times article titled “How Trump’s Protectionism Could Backfire.” Here’s a slice: Tupelo…

Have Investors Priced In Veeva Systems Inc’s Growth?

Veeva Systems Inc. (NYSE: VEEV), a healthcare firm with a market capitalization of $10.3 billion, saw its share price increase by 30.7% over the prior three months. As a large-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. Is there still an…

Peeking Into Future Through Futures, And How Hedge Funds Are Posi

Following futures positions of non-commercials are as of March 27, 2018. 10-year note: Currently net short 305.2k, down 8.1k. For the first time since mid-December last year, 10-year Treasury yields went under the 50-day moving average this week. On March 21 – the day the FOMC concluded its two-day meeting by raising the fed funds…