ECB Doubles Bond Purchases Just As Market Hits Turbulence

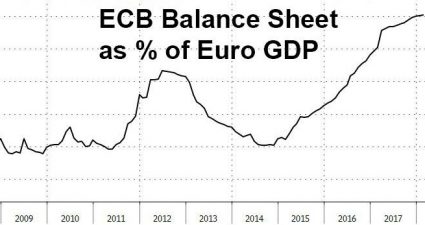

We find it amusing how much digital ink continues to be spilled to predict i) when the ECB will end its QE and ii) whether it will hike before or after it finally stops purchasing government and corporate bonds, or funnier yet, start selling them. The reason for that is that over the past 4…