Danish Proposal The Latest Salvo In The War On Cash

The war on cash continues to heat up with a proposed law in Denmark that would open the door to what Jim Leaviss called “the first step towards an economic revolution that sees physical currencies and normal bank accounts abolished,” in a recent Telegraph column. Last month, we reported on the reasons central banks would love to do…

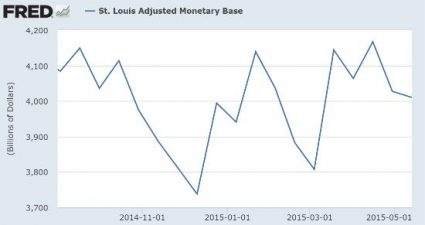

No Money, No Growth

Last August, the US Fed stopped creating new currency out of thin air and dumping it into the banking system. Which is another way of saying the US money supply stopped growing. Here’s the adjusted monetary base — a proxy for the amount of new currency the Fed is creating — over the past eight…

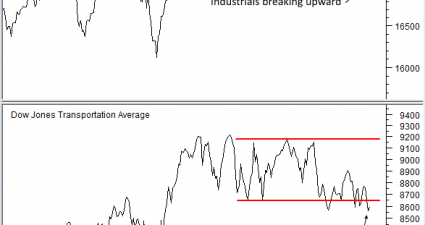

Tale Of Two Indexes

Over the past week the non-confirmation in Dow Theory between the industrials (DJIA) and the transports (DJTA) widened. Both indexes have been painting a line for over two months. Now both indexes have broken out of their lines. The problem is DJIA broke upward and DJTA broke down. This creates a non-confirmation that warns of a…

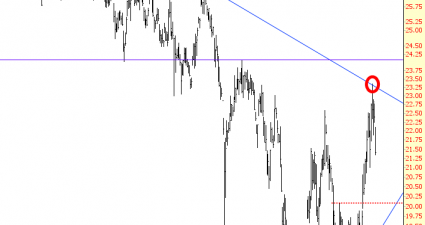

Interest Rate Repulsion

I thought oil would be my superhero today, considering how things started, but it turns out my TBT short was actually the real winner. Interest rates tagged the descending blue trendline I’ve drawn below, and since then TLT has been firming up smartly. TBT, the double-short ETF based on treasury bonds, has been wilting mightily today,…

Retail Sales Weren’t Soft

Headline writers were falling all over themselves yesterday to get the news out that retail sales were weaker than the Street conomist crowd consensus guess. The stock market soared as trading algos surmised that this meant that the Fed won’t raise rates anytime soon. There’s just one problem. As so often is the case, the…

Weakness In Corporate Revenue Is A Bad Sign For ‘Buy-N-Hold

There is one thing that has always nagged me during the 2nd longest bull market run in U.S. history. Corporations have roughly the same revenue per share today as they did halfway through 2007. And yet, sales growth per stock share has only recovered to the pre-crisis levels of 2007, whereas the S&P 500’s price…

Buy-Write Funds: Got You Covered

Fairly early in an investor’s development comes the lesson about covered call writing. The lecture usually sounds like this: “Income can be generated in a flat market by writing calls against assets held in portfolio.” Well, you probably noticed the domestic equity market has been churning on either side of unchanged over the past month….

E

<< Read Part 1: Why Stock Prices Are What They Are This is the second installment in a series that explains why stocks are priced as they are (or for those who prefer a more precise view, why supply and demand trends for a stock are such as to cause the two to converge at…

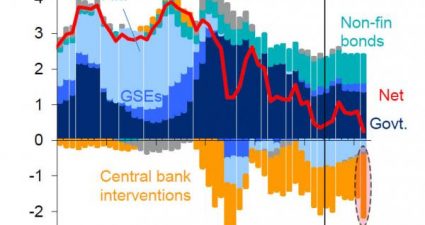

So You Want To Fight The Central Banks? Then Short Treasurys

Following the great financial crisis in which capitalism was almost wiped out due to too much debt, a funny thing happened on the path to recovery (paved with some $57 trillion in even more debt) – Quantiative Easing, that deus ex conceived by central bankers as the miracle tool that would fix the world, stopped working. And it stopped working…