How Apple Lost One American Airlines In Market Cap In Under A Min

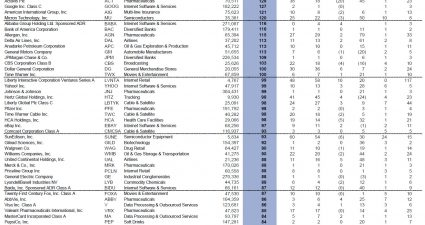

Earlier today, just after the market open, the one company that everyone had once again piled into, and which as of September 30 was the most popular company in the hedge fund community with at least 175 “smart money” institutional fans… Click on picture to enlarge … based on expectations that with every other stock and asset becoming increasingly…