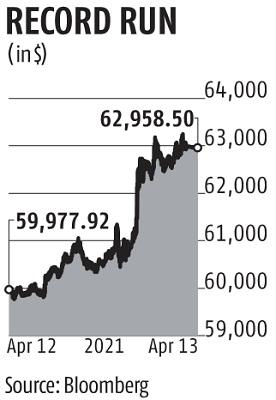

Bitcoin jumped to an all-time high as the mood in cryptocurrencies turned bullish ahead of Coinbase Global Inc.'s listing this week.

The token rose as much as 5.3 per cent to $63,179, exceeding the previous peak in March. Cryptocurrency-exposed stocks such as Riot Blockchain Inc and Marathon Digital Holdings also advanced in US premarket trading.

Crypto bulls are out in force as growing list of companies embrace Bitcoin, even as skeptics doubt the durability of the boom. In one of the most potent signs of Wall Street's growing acceptance of cryptocurrencies, Coinbase will list on the Nasdaq on April 14 at a valuation of about $100 billion.

Coinbase's debut “will mark the first official juncture between the traditional financial avenue and the alternative crypto path,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “As such, a successful addition to Nasdaq should act as endorsement of cryptocurrencies by traditional investors.”

Goldman Sachs Group and Morgan Stanley have announced plans to offer their clients access to crypto investments. Tesla earlier this year disclosed a $1.5 billion investment in Bitcoin and more recently started accepting it as payment for electric cars.

Still, skeptics argue that digital coins have been inflated by stimulus that's also sent stocks to records. Regulators around the world are stepping up oversight and casting doubt on its usefulness as a currency.