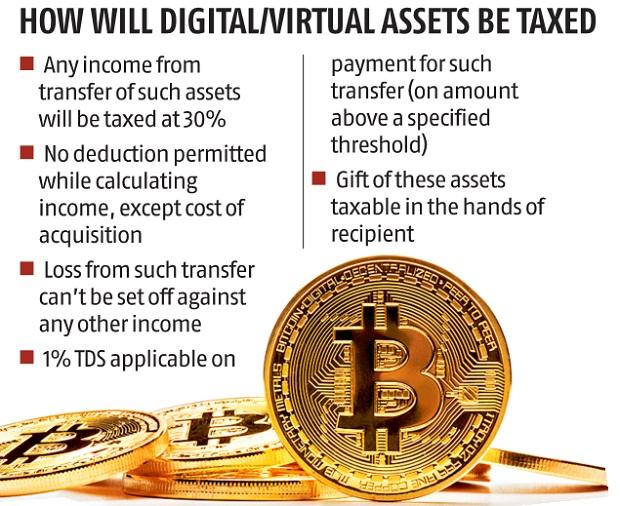

Until now, millions of investors in digital/virtual assets (cryptocurrencies and non-fungible tokens, or NFTs) in the country worried they could be hauled up by the tax department for filing their income-tax returns vis-à-vis this asset class incorrectly. Now, finally, finance Minister (FM) Nirmala Sitharaman has provided clarity on how they are to be taxed. The FM has announced a 30 per cent tax on any income from the transfer of virtual/digital assets.

Recognition at last

Taxing these assets means the government will treat them as a legitimate asset class. An earlier draft Bill had proposed up to ten years in jail for possession, mining, trading or transferring of cryptocurrency assets. Now, the uncertainty surrounding whether they could be declared illegal seems to have ended.

Aditya Chopra, managing partner, Victoriam Legalis (Advocates & Solicitors), regards this as a win-win.

“The government will generate revenue by taxing the transfer of virtual/digital assets. And by bringing these assets under the ambit of taxation, it has also accorded recognition to them,” he said.

“The government will generate revenue by taxing the transfer of virtual/digital assets. And by bringing these assets under the ambit of taxation, it has also accorded recognition to them,” he said.

High rate of taxation

The flat 30 per cent tax rate, irrespective of the holding period, may disappoint crypto investors. Suresh Surana, founder, RSM India, said: “The taxation of virtual/digital assets at 30 per cent plus surcharge and cess will disappoint crypto assets holders. They have not been offered a lower tax rate on long-term capital gains.”

Moreover, no deduction will be provided while computing such income. Only the cost of acquisition can be subtracted from this income. And losses during transfer can't be offset against any other income.

A 1 per cent tax deducted at source (TDS) on payments made for transferring digital assets will be levied above a specified monetary threshold. This is expected to enhance transparency. Says Melbin Thomas, co-founder, Sahicoin: “The government-mandated 1 per cent TDS on every trade will enable it to track crypto transactions and acquire much-needed visibility on the holders and users of crypto assets.” If these virtual/digital assets are gifted, they will be taxed in the hands of the recipient. Utsav Trivedi, partner, TAS Law, said: “The flat and high tax rate of 30 per cent may not act as a deterrent for trading and investing, but it may deter gifting.”

Taxation of past income

Income arising from the transfer of any virtual/digital asset from April 1 will be taxed at 30 per cent. But what about income from transfers made earlier?

According to Rakesh Bhargava, director, Taxmann, “Any transfer of cryptocurrencies on or before March 31, 2022, shall be taxable as follows: Short-term capital gains and business income (due to trading) will be taxable at applicable rates and long-term capital gains at 20 per cent.”

Clarity needed

While the minister's announcements have removed ambiguities on several fronts, a few questions remain. Says Pratyush Miglani, managing partner, Miglani Varma & Co-Advocates, Solicitors and Consultants: “Uncertainty continues on whether goods and services tax (GST) will be levied on such transfer or exchange.” He adds if the applicable GST rate is 18 per cent, investors could be discouraged from investing in these assets.