Coinbase Global's marketplace for nonfungible tokens is finally here in what could be key to reviving the crypto exchange's growth prospects a year after its fizzling public debut.

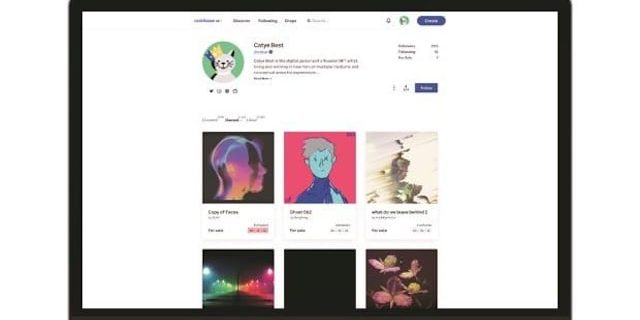

A trial version of its long-awaited platform — designed to sell ownership of digital art and possibly other items — was unveiled on Wednesday in the company's latest attempt to diversify its revenue and bring more predictability to the business.

When Coinbase went public a year ago, investors had high hopes for a growth story. But with sales growth expected to go from triple digits in 2021 to negative this year, shares have tanked to a record low recently.

The social NFT marketplace —which will allow users to trade, “like” and comment on images, similar to Instagram — will be entering a crowded field six months after it was originally announced. A slew of other crypto exchanges and platforms, such as Binance and FTX, have already launched similar marketplaces. Plus, the NFT hype itself is cooling down.

The company is facing increasing competition from not just crypto exchanges, but also online brokerages like Robinhood. Its grand India expansion plan —touted by Chief Executive Officer Brian Armstrong in a recent trip to Bengaluru —was blemished by an obstacle in payment. Sales on OpenSea, the world's biggest NFT marketplace, are down 67 per cent over the past 30 days, per tracker DappRadar.

Coinbase seeks to reduce its reliance on trading fees, which are subject to the whims of retail traders who more recently have been on the sidelines after crypto prices fell from last year's highs.