The past two months have seen a spectacular bear market in cryptocurrencies. This comes after a long bull run, which multiplied cryptocurrency market value, pulled in new investors, and led to serious investment houses setting up crypto indices and advising portfolio exposure to digital currencies.

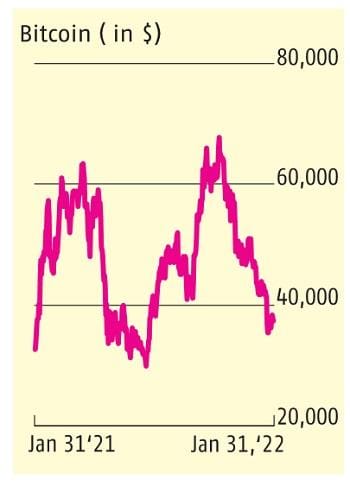

The value of cryptocurrencies.peaked early-mid November 2021. Since then, most of the coins have tanked and it is estimated that over $1 trillion worth of market value has been wiped off. Take the two most high-volume assets: Bitcoin has lost 44 per cent from its peak and it's up about 6 per cent in the last 12 months despite the correction; ethereum has lost 46 per cent but it is still up around 77 per cent over January 2021 levels.

What are the causes of the downturn? First, it's important to note that cryptocurrencies.are anchored to nothing and their prices are purely a function of supply and demand. There is no central agency controlling money supply – it expands by an exact mathematical amount, which is known to all participants. There is no such thing as an interest rate, let alone a policy rate. Unlike fiat currency, cryptos cannot even be benchmarked to the economic performance of the issuing nation.

Hence, these digital assets are driven purely by sentiment. If sentiment is strong, prices can skyrocket as they did through 2020 and 2021. If sentiment is weak, we can see this sort of catastrophic drop. Apart from sentiment being weak, we also have a situation where many crypto-traders may have decided to book profits.

In this time period, global equity markets have also seen corrections, which range 8-10 per cent in most large markets. Those declines are driven by fears, now more or less confirmed by the latest FOMC (Federal Open Market Committee) meeting that the US will tighten monetary policy to combat inflation. If the Fed tightens, so will other large central banks facing high inflation. This leads to a risk-off attitude.

There are also fears specific to cryptocurrencies. One is that of government regulation and oversight. China has banned trading; India has drafted legislation that is somewhat ambiguous, and which may be interpreted to either completely ban the entire asset-class, or to selectively ban many cryptos, and only allow trading in a few under careful supervision.

China and India both host large crypto-trading communities, which are now uncertain about the future.

China and India both host large crypto-trading communities, which are now uncertain about the future.

A fall in crypto prices may result in popular support for more regulatory pressure –more citizens will ask for oversight, and governments may be happy to oblige. There is also pressure from environmentalists to stop crypto-trading, or drastically change the algorithms.

Verifying trades on the blockchain and mining new coins are computationally intense, done by syndicates using server farms with special chips. The carbon footprint is huge. After the China ban, syndicates are shifting locations.

There's environmentalist pressure to shut down or change mining procedures for lower carbon intensity. The suggested changes to proof of work mining could leave cryptos more vulnerable to fraud, and the money supply could be more easily controlled by a few big consortia.

For all these reasons, the asset class is currently under pressure and likely to stay under pressure until the more pressing policy issues are resolved. The assessment that crypto is an alternative asset class, which can be a hedge, remains valid. But portfolio theorists betting on this will have to allow the extreme volatility we've seen over the past 3 years.