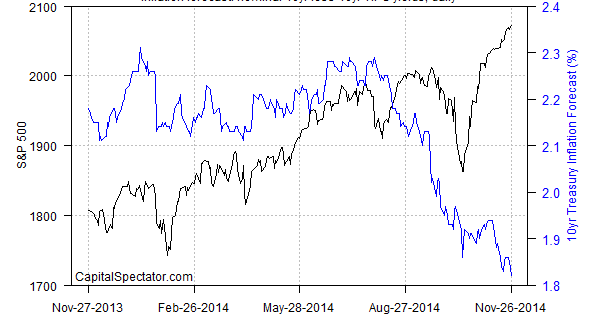

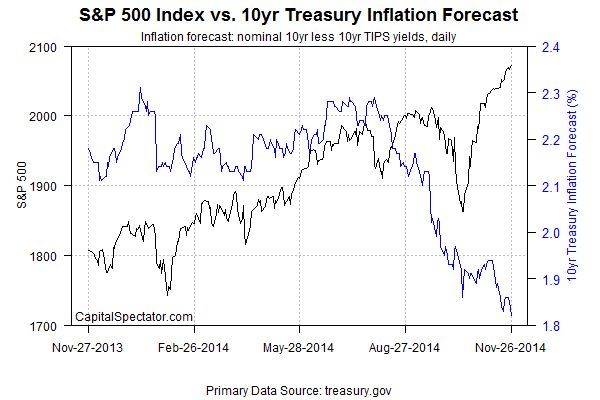

The federal reserve may start raising interest rates next year for the first time in nearly a decade, but the focus at the moment is on deflation risk, or so it seems by way of the market's softer inflation forecast via a closely followed yield spread in Treasuries. The implied outlook for inflation slumped to a three-year low of 1.82% on Nov. 26, based on the difference for the nominal 10-year yield less its inflation-indexed counterpart. This market-based estimate is down sharply from the recent peak of 2.29% as of this past July 30. It's unclear how much of the market's focus on deflation risk is tied to worries about the macro outlook in Europe and Asia vs. the US. This much is clear: if Mr. Market continues to lower his inflation estimate, it's going to be tougher to argue that the US economy is immune to the macro troubles that are bubbling elsewhere in the world.

Then again, maybe the crowd will rethink its recent appetite for lesser inflation estimates in the wake of today's news that Europe's biggest economy can hang on to a mild degree of growth. Retail spending in Germany rebounded last monthafter tumbling in the previous month—a tumble that raised worries that the so-called growth engine for Europe was sputtering or worse. One data point is hardly conclusive, but for the moment at least the prospects for Germany have improved slightly.

Q4 GDP in Europe is still expected to tread water, although recent estimates have been inching higher lately, according to Now-casting.com. There's also some evidence for thinking that the recent slowdown in China's growth may be stabilizing. This week's update of business sentiment for China in October shows a mild degree of improvement.

Nonetheless, the crowd has turned cautious lately, spurring a rally in bonds around the world. “I don't see much that can hurt this rally right now, I would stick with the trend,” Padhraic Garvey at ING Groep NV in London tells Bloomberg.“There's a real comfort at the moment in extending out curves because of the disinflationary impulse that's dominating globally.”