A new AIMA research paper discusses “the alignment of interests between hedge fund managers and investors” as it manifests itself in changes in the hedge fund business model.

There have always been features in the relationship that were designed to produce such an alignment. As Michelle McGregor Smith observes, in her forward to the new paper, the concept of “skin in the game” is decades old. Likewise, the conception that fund managers should not charge performance fees so long as they are below an earlier high water mark is a venerable one. Nonetheless, investors since the global financial crisis of nearly a decade ago have been demanding a good deal more than that. And managers are giving them more.

The study is based on a survey in which 120 hedge fund managers responded. The participants represented approximately $500 billion in AUM.

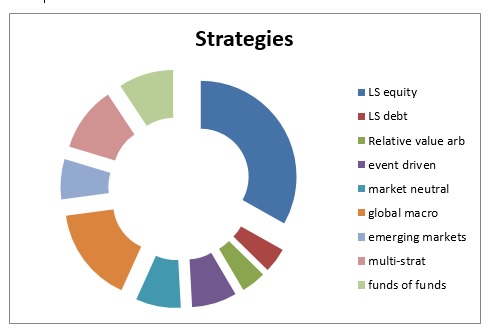

As the donut below indicates, roughly one-third of the sample consisted of long/short equity managers. The next largest group employed global macro, at least for their “principal flagship fund.”

Source: AIMA, In Concert: Exploring the alignment of interests between hedge fund managers and investors. Adapted from Fig. 1, p. 6.

Part of the change underfoot in recent years in the manager-investor relationship involves transparency. That is, the disclosures managers make have dramatically increased since 2008.

Ain't No Such Thing as a Free Lunch?

The report observes, sensibly, that an increase in transparency is not a free lunch. “The increased variety of fund risk reports that can be requested by an investor has undoubtedly pushed fund costs higher.”

It is not the case that all investors are equal, in their demand for information about fund positions or risks, or in the costs that they can reasonably be asked to pay to satisfy those demands. It will often be in the best interests of a large body of investors to allow or encourage managers to impose managers to impose additional charges on those few investors who want reporting in excess of normal requirements.

Tiered Fee Structures

Another part of the change involves the development of tiered fee structures. Most hedge fund managers with AUM below $500 million say they are willing to introduce tiered management fee structures in the event their fund's AUM passes a certain threshold. This is despite the act that the introduction of tiering would cost them revenue – one introduces tiers by offering discounts and rebates, after all.

When pressed on where the threshold would be, one equity-based manager with $300 million AUM put it at $500 million.

The strategy that a fund pursues has an impact on its costs, and this in turn has an impact on its willingness to grant discounts or rebates. This is most true of credit funds, certain equity-based strategies, and multi-strat funds.

Managers typically have to take a harder line on fees earlier in the life of a fund, when they face “fixed operating costs from a lower AUM base,” as the report says. But as the fund grows and economies of scale kick in, managers can operate more efficiently, and this makes it possible to consider a tiering of fees.

Co-Investment

The report also discusses the growth of co-investment arrangements. Nearly half (48%) of managers asked said that they either offer or are considering offering co-investment to their investors through “either a particular investment opportunity or [a] jointly managed fund.”

Oddly perhaps, the greatest receptivity to the idea of among two very different sets of managers as defined by scale – those with the fewest assets under management, and those with nearly the highest level of AUM. More than 30% of those with AUM under $100 million say that yes, they do offer such opportunities, and another 30+% say they have it under consideration. Likewise, among the comparative behemoths with AUM above $1 billion, though no higher than $4.9 billion, nobody offered a flat “no” to this question. More than 40% of the behemoths' managers said “yes.” Managers in the intermediate range, and managers of the super-behemoths with AUM of $5 billion and above, were alike less receptive to the idea.

In general, the report emphasizes, managers today “are keen to develop meaningful partnerships with investors who are willing to see beyond any short term fall in a fund's performance and remain committed to the strategy of the fund.”