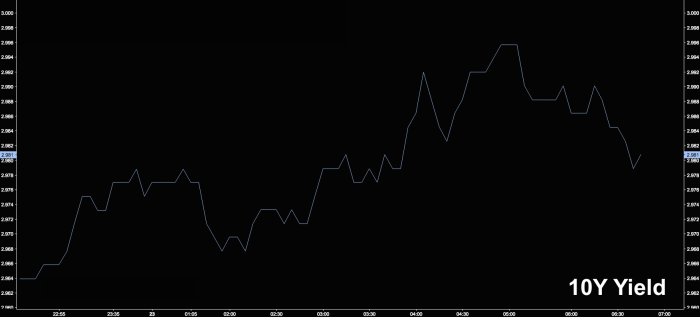

Well, it looks like it's going to be all about 3% on 10s on Monday, or at least early on.

The selloff in the long end late last week and accompanying steepening has everyone squarely focused on that oh so scary round number again and yields ticked up a bit more overnight, ensuring that your coworkers will be forced to begrudgingly try and come up with some new factoid about 3% so they can impress their colleagues.

The dollar rose for a fifth consecutive session as yields are underpinning the greenback with folks apparently willing to overlook (for now) the deficit issue and the fact that Trump has adopted a weak dollar policy by proxy. Of course, positioning shows no one is actually “ignoring” the developing structural headwinds.

USD/JPY highest since February 13:

This ahead of the ECB and the BoJ which makes for a mildly interesting setup. “It strikes me that with all the news flow, geopolitical and relative monetary policy related, the dollar short position increased last week, yet you don't have to be a dollar bull to wonder why,” Bloomberg's Richard Breslow writes on Monday morning, adding that “the dollar index isn't out of the woods, but support levels look a lot clearer than resistance.”

It's worth noting that 10Y yields in China rose by the most in six months on Monday with traders citing tightening liquidity on corporate tax payments. This, of course, comes on the heels of an impressive rally in Chinese sovereign debt last week following the RRR cut. Some folks are concerned that the recent slide in Chinese yields is saying something bad about emerging markets or about the global economy more generally.

“What makes the move more disconcerting is that there has been a very close correlation between China yields and the global economic surprise index over the last year,” Morgan Stanley recently wrote. “This raises the question as to whether China is the potential source of slowing economic momentum through the global economy.”