Amazon vs Wallmart

The electronic commerce and cloud computing company, Amazon, which is based in Seattle, Washington is once again outpacing its own achievements and looks to be infinitely growing. Amazon, who surpassed Walmart as the most valuable retailer in the United States by market capitalization, is looking to make history once more. The firm is on the path to reach a market capitalization of $1 trillion, with its Web Service being a primary contributor to this. Moreover, the firm looks to diversify itself into the logistical sector and thus giving it control over its own carrying channels. The success of Amazon has even lead to some predicting that the e-commerce giant will reach a share price of $1,000 by the end of 2017. Although, some have raised suspicion over this valuation, and have linked the sales of more than 1 million shares of Amazon stock, by CEO Jeff Bezos earlier this week as pre-determined.

The firm's, shares appear to be on a constant rise and, with the reasons highlighted in this article, it is likely to be a beneficial long-term asset to add to one's portfolio.

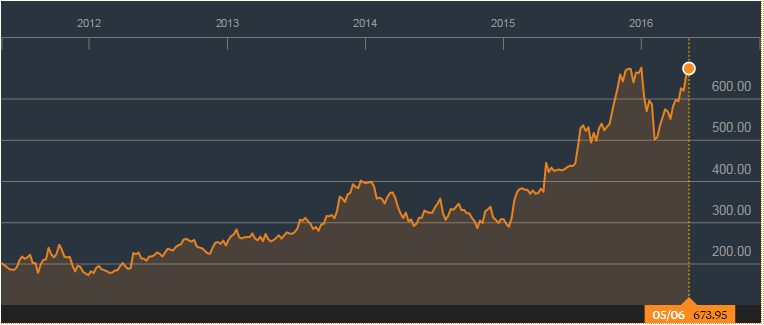

AMZN shares are priced at 709.92$ at the time of writing. Below is a chart which shows AMZN impressive stock price increase for a 5 year period.

(Source: Bloomberg)

Will Amazon hit $3 Trillion by 2026?

Earlier this week, the founder and CEO of Venture Capital (VC) firm Social Capital has unleashed an optimistic yet realistic estimation for Amazon's market capitalization at the Ira Sohn investment conference in New York.

Chamath Palihapitiya, the CEO of the VC, suggests that the company would be worth 10 times more than its current $300 billion market capitalization and exceed $3 trillion.

He states: “If you believe in the Internet you have to believe in Amazon,” he continued “If you believe in buying things you have to believe in Amazon.”

Palihapitiya estimates that Amazon's gigantic retail business alone will be worth $1 trillion as demonstrated by the number of units sold which grew from 30 billion a year from 6 billion last year. Moreover, the company's web service is also cementing itself as the monopoly of internet storage and cloud sharing. Palihapitiya, argues that by 2025 the company will post revenue of $432 billion at a 30% EBIT margin.

Palihapitiya believes CEO Jeff Bezos will reinvest much of the cash gained by these businesses in high-growth opportunities, this reinvestment will spur another $500 billion to the value.