Universal Forest Products (UFPI – Analyst Report) has been banging up against all-time highs over the last month and is the Bull of the Day after it recently became a Zacks Rank #1 (Strong Buy).The company designs manufactures, treats and distributes lumber products for the do-it-yourself, manufactured housing, wholesale lumber and industrial markets.Its products include pressure-treated wood, engineered roof trusses, dimension lumber and value-added lumber products, including lattice, fence panels, deck components and kits for various outdoor products sold under the its PRO-WOOD, Deck Necessities, Lattice Basics, Fence Fundamentals and Outdoor Essentials trademarks.

Universal Forest is based in Grand Rapids, Michigan and had 7,000 fulltime employees. The company has a market cap of $1.7 Billion with a Forward PE of 19. The stock pays a dividend of 0.96% and sports Zacks Styles Scores of “A” in Growth and “B” in Momentum.

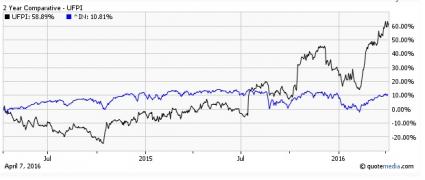

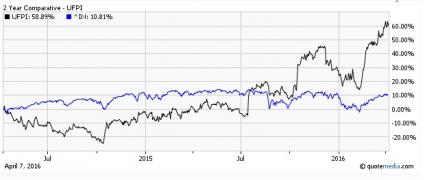

The company has seen an amazing run after a pullback to $61 in early February. UFPI currently sits around $85 which gave dip buyers a move of almost 40%.Investors must now decide whether they should wait for another pullback or chase the stock higher.Over the last two years we have seen the stock surge 60%, while the S&P is only up 10%.

Earnings and Estimates

Universal Forest reported on February 17th and saw Q4 earnings of $0.93 versus the $0.78 expected with revenue coming in at $653.6 Million verse the $661 Million. While revenue was light investors focused on the bottom line and bought the stock up to all-time highs. In addition to the headline numbers, the company reported residential construction revenue of $221.2 Million (-1.6% year over year) and retail revenue at $239.7 Million (+13.6% year over year).Industrial revenue came in at $209.3 Million, +4.7% year over year.

CEO Patrick M. Webster commented that the results come at a time when the lumber composite price was down 15.5 percent compared to the fourth quarter of last year, and down 13.6 percent for the year, reducing the company's selling prices.