Bemis (BMS) is one of the most unknown Dividend Aristocrats. It does not have the instant name recognition that fellow Aristocrats McDonald's (MCD),Coca-Cola (KO), or Wal-Mart (WMT) have. Bemis is a global packaging manufacturing with a market cap of just under $4 billion; very small for a Dividend Aristocrat.

The company has paid increasing dividend for 31 consecutive years and was founded in 1858, making it one of the oldest businesses on the market. Bemis employs `17,000 people in 61 facilities located in 11 countries around the world. The company is the focus of Part 47 of the Dividend Aristocrats In Focus series. Bemis' operations are analyzed below to give a better idea of how the company functions.

business Overview

When I last wrote about Bemis, I discussed how their business was broken down into 3 segments: US Packaging, Global Packaging, and Pressure Sensitive Materials. The US and Global Packaging segments are obviously related and help the company reach greater efficiencies through scale. The Pressure Sensitive Materials segment contributed just 6% of total operating income for the company through its full fiscal 2013. Bemis recently announced the sale of its Pressure Sensitive Materials business to the private equity group Platinum Equity for $170 million. The Pressure Sensitive Materials segment was sold for an Price to EBIT ratio of about 5.67. Bemis' CEO William Austin best sums up the reasoning for the divestiture:

“Bemis is now positioned to dedicate all of our resources to accelerating strategic growth in our core flexible packaging business”

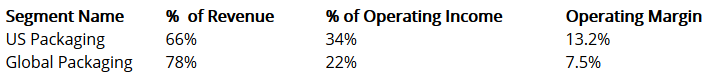

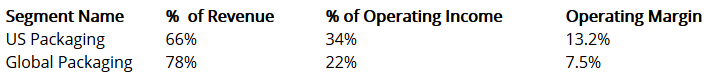

The percent of total revenue and operating income each of Bemis' remaining two segments has contributed to the company though the first 9 months of its fiscal 2014 are shown below to give an idea of the size and relative importance of each segment to Bemis

Competitive Advantage