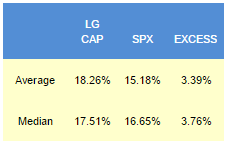

Since 2010, our top scoring weekly has outpaced the SPX by a median 376 bps in the following year. The best performers from our list one year ago are RCL up 74%, FB up 65%, MU up 65%, AAPL up 50%, and HPQ up 45%.

The average large cap score is 69.48, below the four week moving average score of 69.57. The average large cap stock is trading -10.60% below its 52 week high, 2.78% above its 200 dma, has 3.79 days to cover held short, and is expected to post EPS growth of 10.8% next year.

The top scoring large cap sector is healthcare. Consumer goods, services, utilities, and technology also score strongly. Financials score in line. Industrial goods and basics score below average.

The following chart shows major market index seasonality for Dec. through February. The SPY has gained in eight of the past 10 years.

The best large cap industry is healthcare plans (WLP, UNH, CI, HUM, AET). Wholesale drugs (MCK, ABC, CAH) demand benefits from rising insurance enrollment, ageing America, and generic price stability. Growing high bandwidth content demand supports diversified communication systems (LVLT, CCI, AMT) as additional capacity is added to established towers. Emerging markets and convenience store channel expansion offers upside for major food (MDLZ, ADM). Diversified utilities (ED, SCG, WEC, AEE, NU) benefit from year-over-year price growth.

No basic materials basket scores above average — stay stock specific. In consumer goods, focus on major food, textiles (NKE, RL, MHK, LULU, VFC), and processed & packaged goods (MKC, GMCR, MJN, CAG, PEP, CPB). The top financials industries are REITs (HCN, PSA, HCP, AVB, SLG, VTR, SPG, MAC), P&C insurers (CB, WRB, ACE, XL, TRV, HIG), and credit services (SLM, MCO, EFX, ADS). In healthcare, concentrate on healthcare plans, medical instruments (BDX, XRAY, SYK, CFN, BCR, COO, BAX), and biotech (GILD, ILMN, CELG, REGN, INCY, MDVN, BMRN). The top industrials groups are aerospace/defense (TDG, RTN, GD, NOC, COL) and industrial equipment (PH, ROP). In services, drug wholesale, air delivery/freight (UPS, CHRW, FDX), and diversified entertainment (DIS, TWX) are best. Diversified communication services, data storage (WDC, NTAP, STX), and technical & system software (INFY, ANSS, ADSK, SNPS, CNQR) are the top industries in technology. In utilities, buy diversified utilities and electric utilities (XEL, AEP, SO, NEE).