Amid the persistent political scandals (including pay-for-play; or influence peddling or any other such embarrassments whether to AT&T or others); it is also an environment of movement to improve regulations; stimulate business; but sort of turn blind-eyes toward persisting systemic concerns.

Diversion or not; the President's ‘drug price' speech does talk of seriously restructuring an entire leg of the economy; and probably we all agree that is necessary. The reality is it will take months to see how this goes and is also (doubtless) a way of conveying what the ‘people' want; not lobbyists for drug and Pharmacy Benefit Managers, on either side of the aisle.

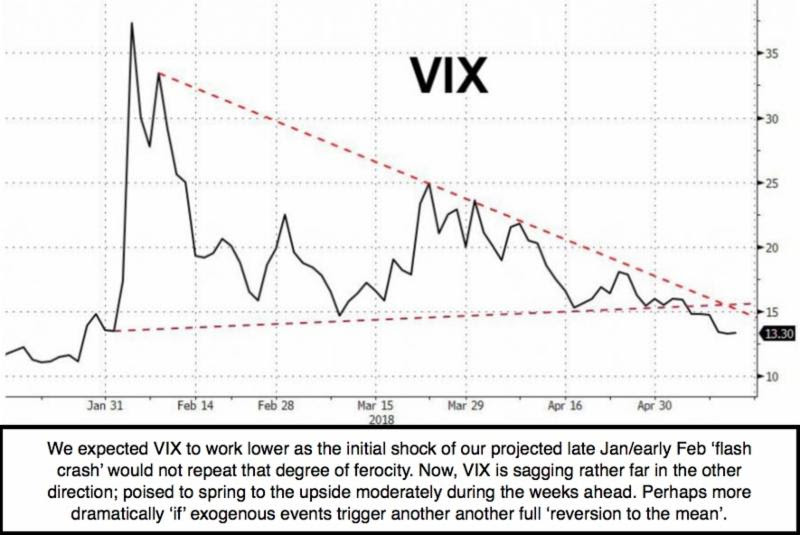

Given time constraints here in San Francisco; let's just summarize the DJ gaining about 600 points; the VIX dropping into lower levels (but not likely to stay there for a very long time); and both credit markets and the Dollar not significantly changed; while many technology stocks were softer.

In sum: we have a form of suspended animation above the former battle of a ‘descending triangle', and a bearish capitulation in the wake of S&P's upside resolution. Follow-through appears greater than breadth reveals, because many of the ‘narrow universe' of leaders are consolidating while a lot of smaller-cap stocks are trying to shoulder the burden; plus Oil too.

This is that stage where you did get a short-term bullish resolution; but at a high level, where aside catch-up to a degree from the already-corrected (AT&T ‘not' declining on the embarrassing news of the influencing efforts), is an example of stocks that already corrected a lot in recent months. For sure that does not prove a ‘base' built yet; but hints at contrasting value of actual value stocks versus the FANG + types that mostly are fading a bit; or just hanging-out at high levels.