I've got no idea why pundits continued to describe the week's more dramatic oscillations, and Wednesday's comparatively milder choppiness, as just an impossible to comprehend forest of uncertainty.

That's why I called for an ‘automatic rally' at the time; but only for trading, not for investing. Why? Because I thought there was nothing attractive in terms of forward prospects to justify more than trading moves into Spring at best, and then we'd see new troubles.

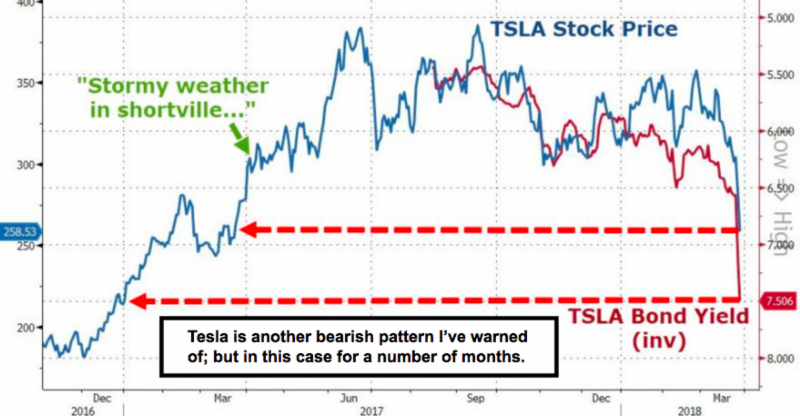

Then we got the more recent break as I described with a symmetrical or similar pattern breakdown (followed by false rebounds); and now we're at the secondary test lows; which in theory are not holding together well.

Bottom line: there is no change in our overall assessment. Whether we get a breakdown tomorrow (last day of the Quarter and most leave early for both Passover and Easter holiday observations), or they drag it out a big longer, we suspect the risk is increasingly significant for a break to a lower level.

Probably some algorithmic after-the-fact signals would also be generated by such a move (and as the lateral low of 2550 or so comes out later on) hence one has to be prepared for at least the possibility of more drama.