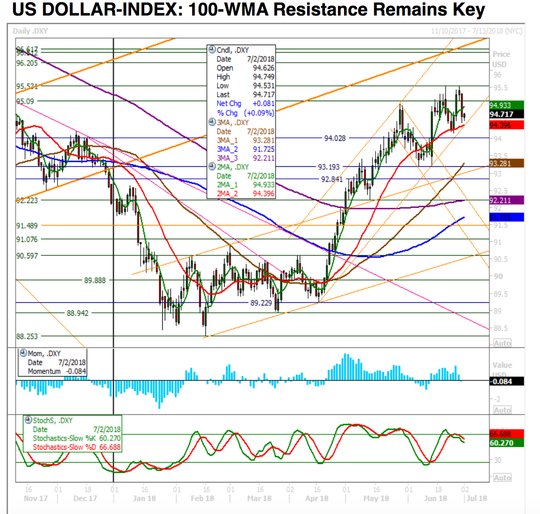

Geopolitical fears remained front and center for the start of the third quarter trading. We are starting the quarter with risk off in equities, but bonds are not bid up enough to counter the pain and the USD is stronger. It's Monday and the weekend news didn't bring any relief for China and the trade tariffs looming. The EU warned of a $300bn hit to its auto sector over US car import tariffs. Nor did it bring much surprise, as Mexico elects AMLO as President– a left leaning populist with 53% of the vote. This brought the MXN 1.3% stronger to 19.6406 but it's back over 20 again tracking USD gains elsewhere. The weekend didn't offer up much respite for the embattled German Chancellor Merkel as she continues to face political turmoil over immigration with her coalition. Germany's Interior Minister Seehofer offered to resign over the migration issue as he said the EU agreement did not go far enough. However, has delayed handing in the letter for one more day of talks. The weekend didn't bring much clarity over Italy and the EU either, as Italy's Salivini said next year's European elections are an opportunity to create an “international alliance of populists” and overcome a “Europe of the elites.” The UK hopes for a Brexit deal continue to elude – with UK Robbin's saying Brussels will not offer a bespoke trade deal and with the UK May Cabinet meeting later this week to discuss solutions. As for the oil market, Trump tweets on a side deal with Saudi were pulled back by the White House noting that King Salman bin Abdulaziz affirmed that Saudi Arabia has 2 million barrels a day of spare production capacity “which it will prudently use if and when necessary to ensure market balance and stability, and in coordination with its producer partners, to respond to any eventuality.” All of these stories seem to dominate over the key economic reports with Japan Tankan weaker than expected, the EU PMI reports mostly weaker – except for Italy – and with doubts about orders and prices. There is a sense from the data that growth is holding, jobs increasing, but export concerns are hitting at optimism and that prices are beginning to hurt. This isn't stagflation or a world set for a recession, but one that is pulling back from its best growth in a decade and so the mood depends on politics and policy. For today, it's the USD that is leading the overall risk barometers from EM to Asia to EUR and GBP – all seems to go back to the balance of growth and inflation with 95.53 the key level to watch.

Question for the Day: Is today about growth and greed or facts and fear? The reaction function of central bankers to data in a world of geopolitical noise matters this week. Reading how the FOMC will react to tariffs and the pass-through of inflation from them to consumers and business will be key. Similarly, the rest of the world's plans of rate normalization rests on how they balance fear from greed in the economy. The RBA meeting tomorrow will be a key test of this juggling as 1Q GDP was stronger than expected, job creation better, but worry from global risks – trade concerns between US/China, housing prices dropping, business and consumer moods. Here are some recent central bank comments on this balancing act.