The start of July and the summer heat wave comes between a week that is caught with the US Independence Day holiday and the World Cup. Most investors logically want to go home and cool off, the noisemakers are hard at work. In fact, July will be anything but a vacation for those watching geopolitics. The US President has meetings with NATO and European Union leaders as well as Russian President Vladimir Putin scheduled for July. We also get the longest lunar eclipse of the century and with the blood moon even more apocalyptic warnings. Throw in 2Q earnings and more China/US talks and you get the dog days of summer. Over the weekend, there were a number of key stories to unsettle markets:

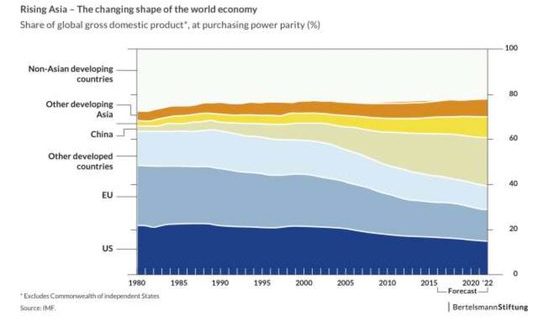

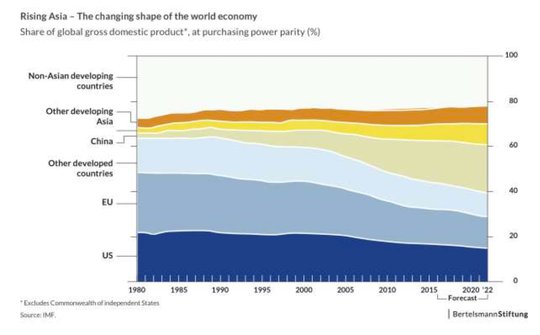

What these stories point out is the driving force of growth and confidence data and how central bankers react to them against the seemingly never-ending string of negative geopolitical headlines as populist politics and nationalism erode the faith in globalization and government institutions. The rise of Asia – particularly India and China – as world superpowers in terms of growth and economic importance describes the last 50 years and the present storm puts some of this into question but not all of it. The ability for the world to continue to lift up the people and add another 1 billion to the ranks of the middle-class rests on getting this moment right and some of that is seeing Europe return to growth, the US trade policy turn positive with real bilateral deals, and China stabilize with more reform, more confidence. The dog-days of summer are just that a few days of heat and stagnation, but they don't last, like fear in markets, they pass.

Question for the Week Ahead: Is US growth in 3Q going to reflect a hit to confidence? The markets ended last week with an upbeat mood. This reflected hope that Trump would back down from extreme tit-for-tat tariffs – as the fear of a global conflict over trade turns real. July 1 brings Canada tariffs, July 6 brings Trumps decision on China and likely retaliation. The Friday rally also reflected hope that the worst case for Italy and Merkel were wrong and that the markets would see a longer summer. Value in carry and EM remains a key hope for many that witness the significant pain in EM FX, stocks and bonds in 2Q. The biggest issue for many investors is in the US outperformance in growth and so in the FOMC rate hiking to continue. This feedback loop of geopolitical fears to consumer confidence is essential to getting 3Q trading right. The hit of US confidence in 2Q was minor and while many will make the slower personal spending an issue for 2Q growth – the rate is still well over 3.5% in most now casting models with some still over 5%.

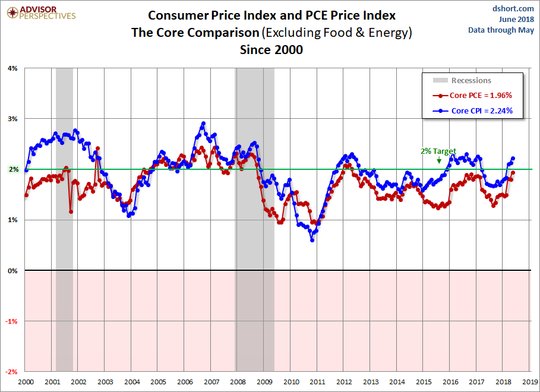

The cost of energy in 3Q seems to be the big issue to watch as it bleeds into inflation and into how central bankers react. The US PCE/CPI are both over the FOMC target. If the jobs report in the week ahead proves to be strong the room for the FOMC to pause because the rest of the world is squeamish over US trade policy or because of political noise at home becomes less important. The risks for the week ahead revolve around the data, the way the FOMC reacts to it and the confidence of business and the consumer to put it all into perspective.